[Machine Learning for Trading] {ud501} Lesson 21: 03-01 How Machine Learning is used at a hedge fund

Posted ecoflex

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了[Machine Learning for Trading] {ud501} Lesson 21: 03-01 How Machine Learning is used at a hedge fund相关的知识,希望对你有一定的参考价值。

a data-centric way to build predictive models

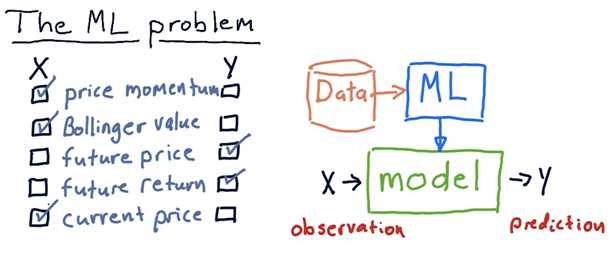

The ML problem

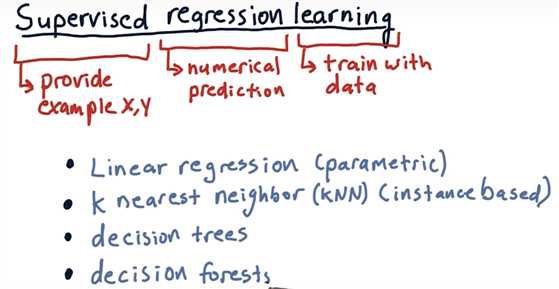

Supervised regression learning

Robot navigation example

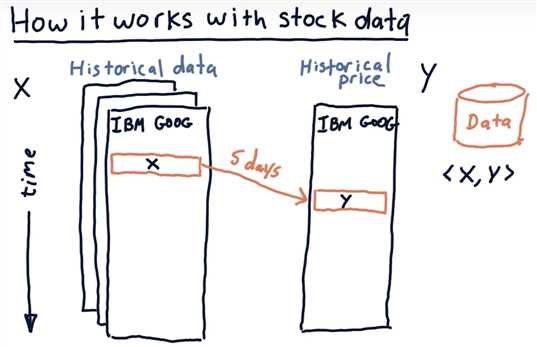

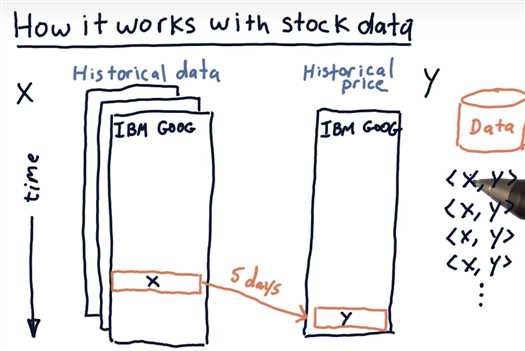

How it works with stock data

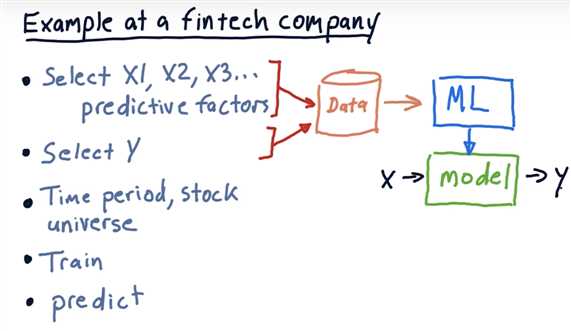

Example at a fintech company

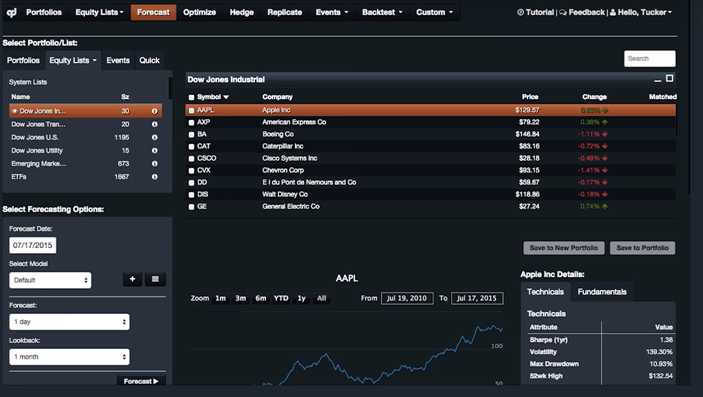

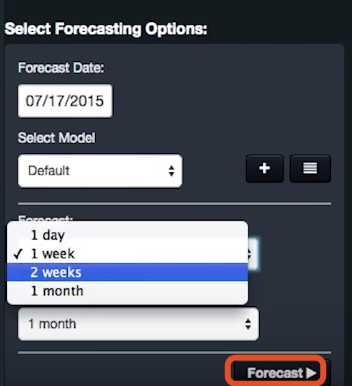

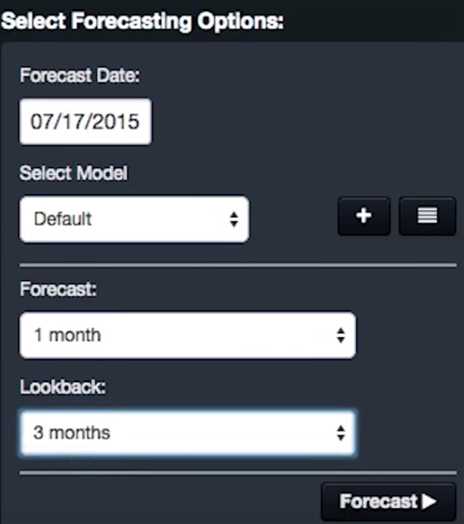

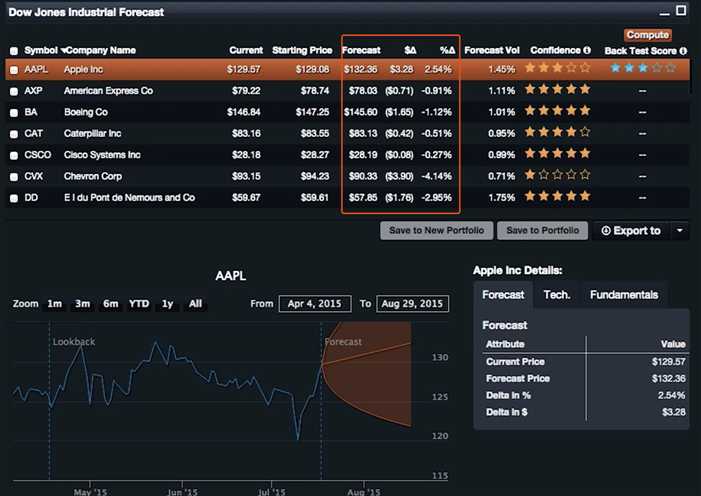

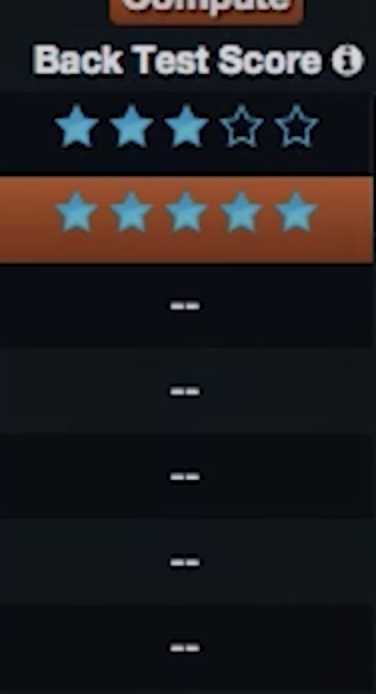

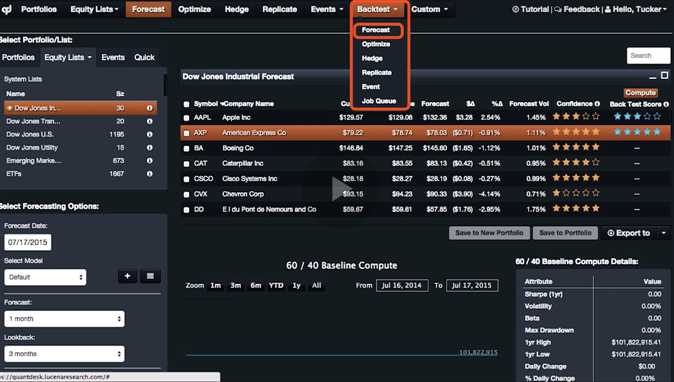

Price forecasting demo

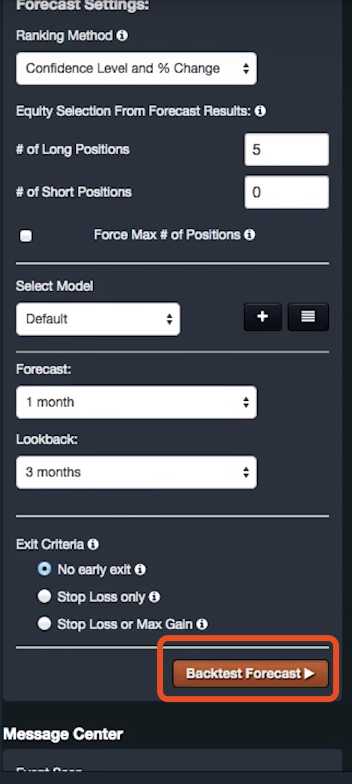

QuantDesk

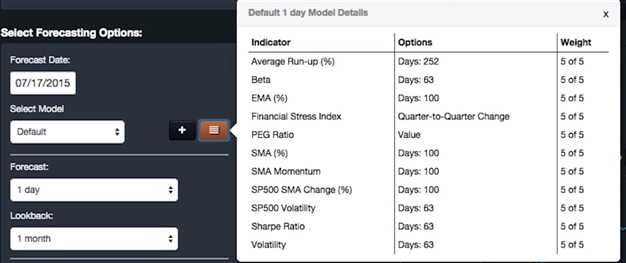

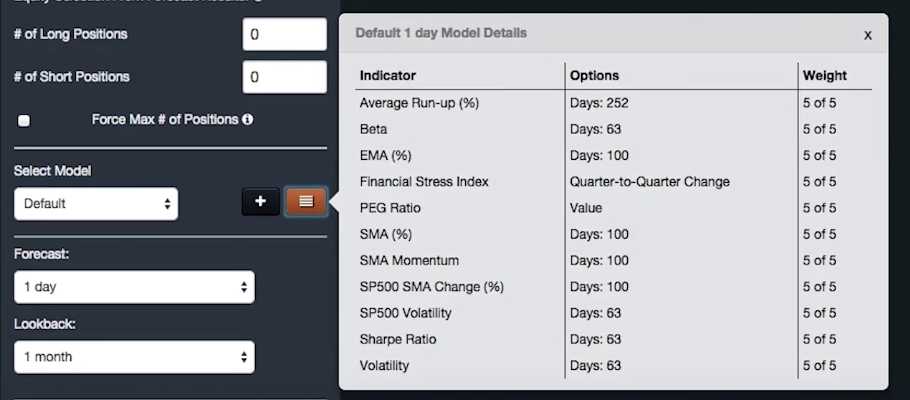

factors we are using now <= choices of these factors are from another genetic algorithm

<= roll back time, and we look over all this last three months and look forward one month, see how accurate all those predictions were

<= roll back time, and we look over all this last three months and look forward one month, see how accurate all those predictions were

https://lucenaresearch.com/#register

https://quantdesk.lucenaresearch.com/#login

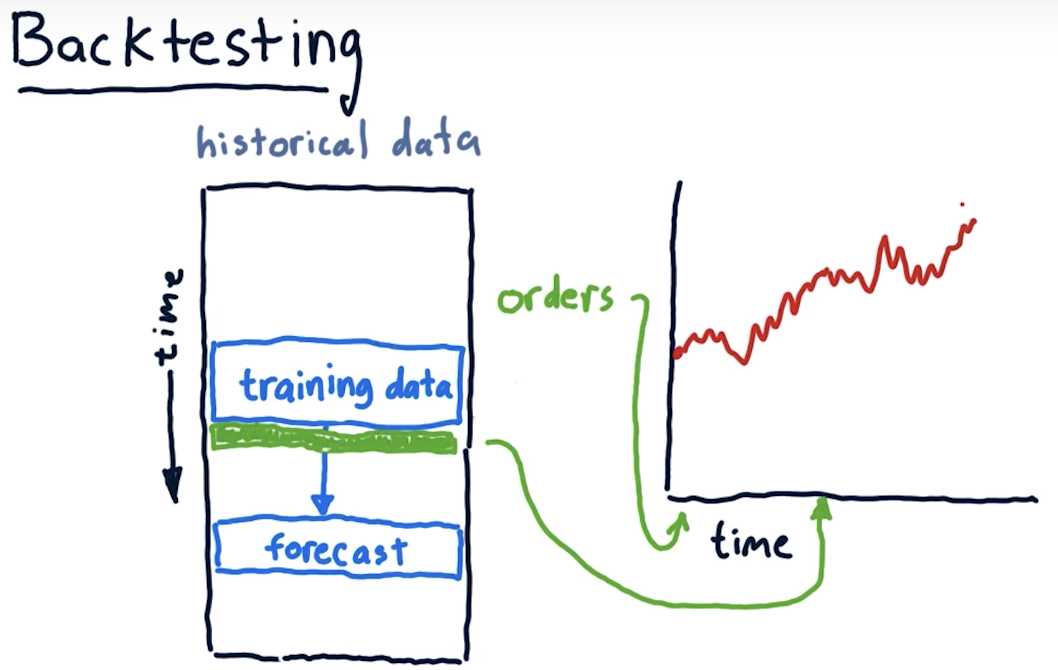

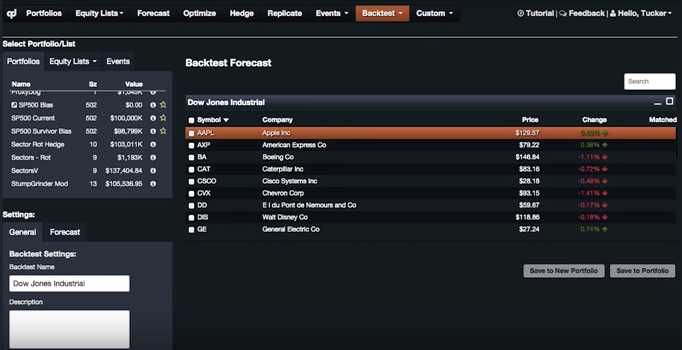

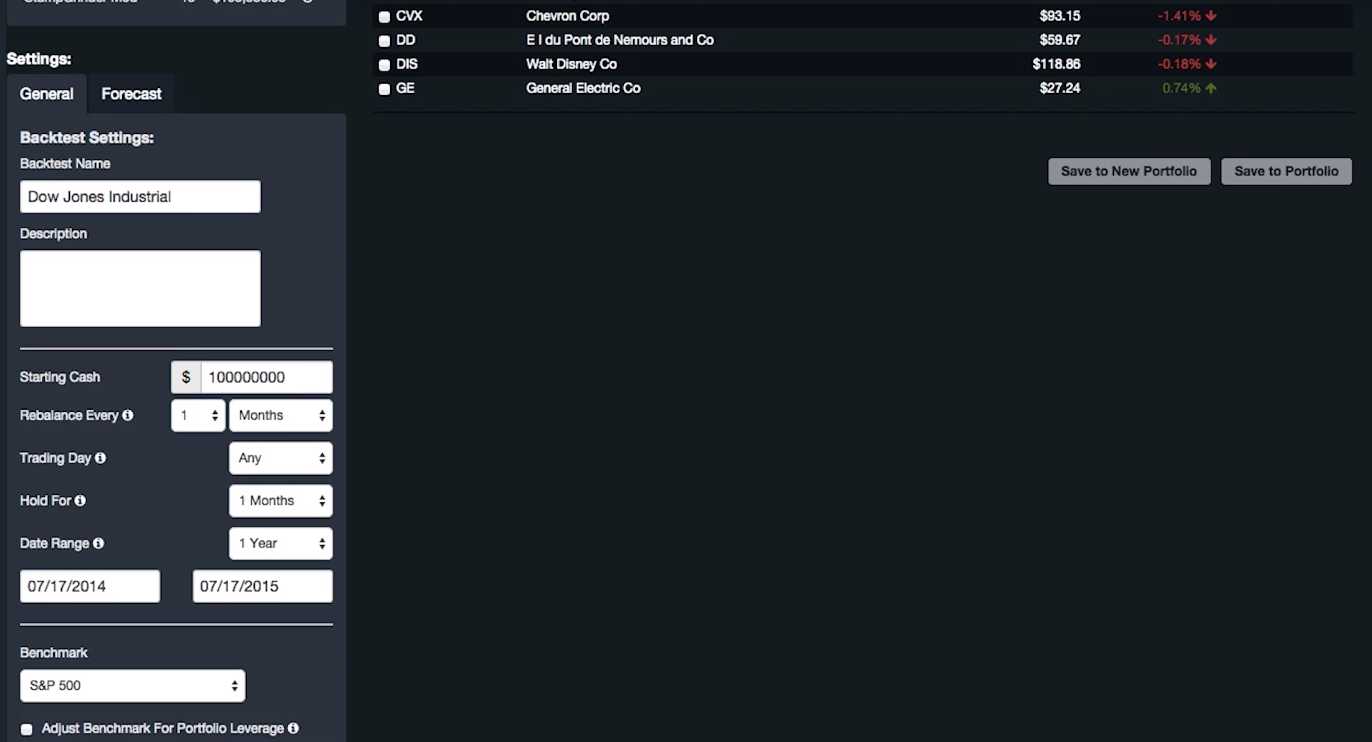

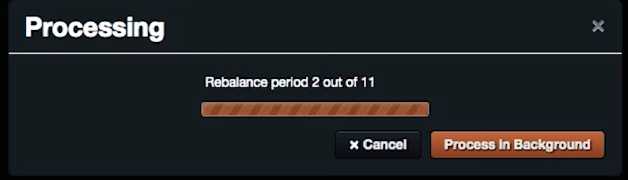

Backtesting

ML tool in use

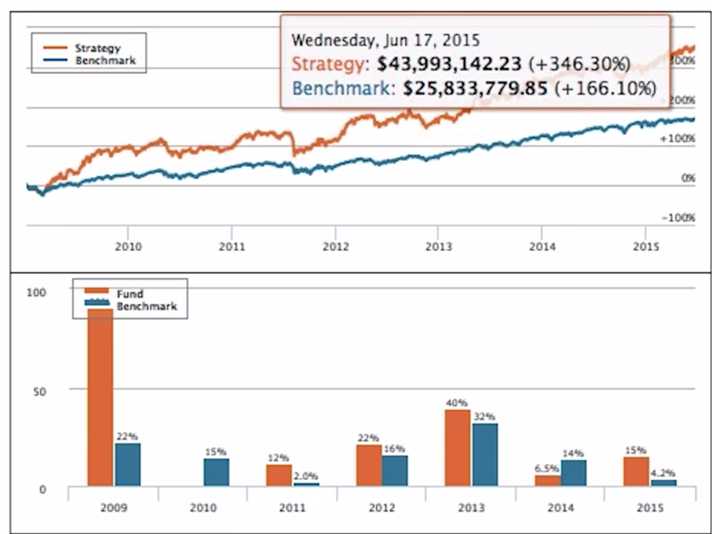

orange line => historical value of our portfolio

blue => benchmark (S&P500 here)

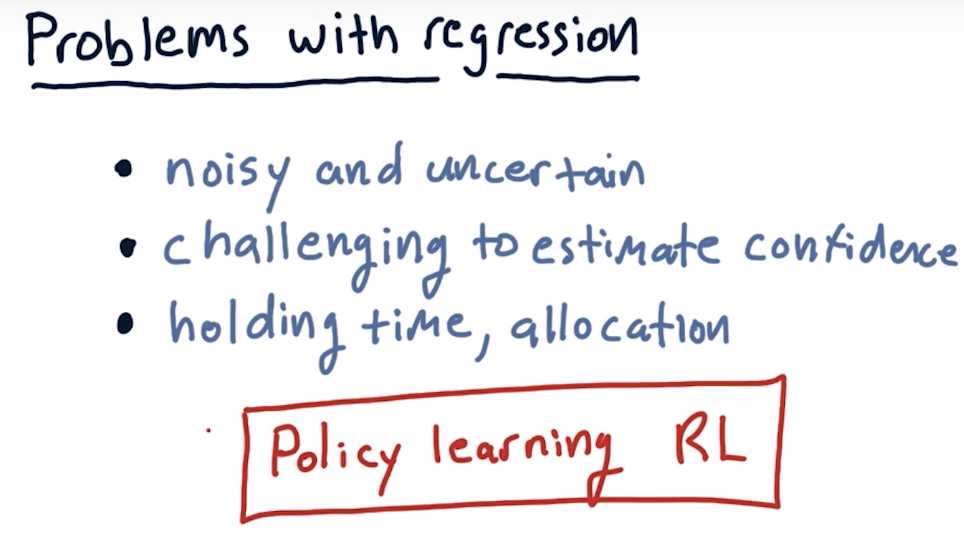

Problems with regression

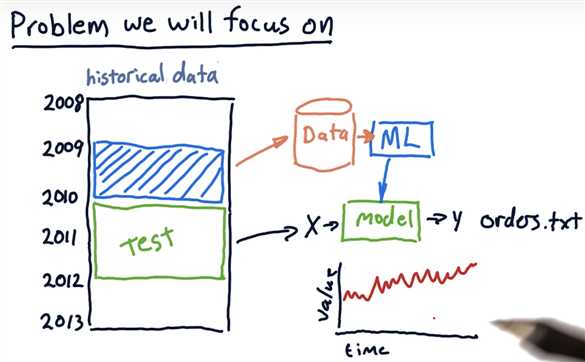

Problem we will focus on

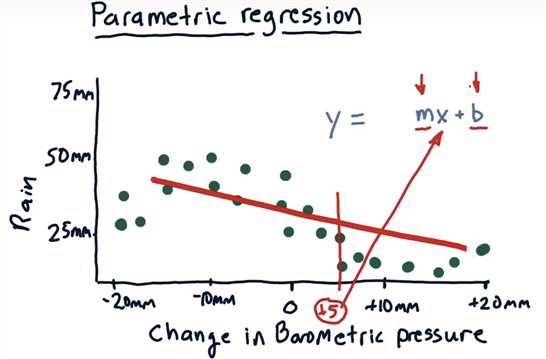

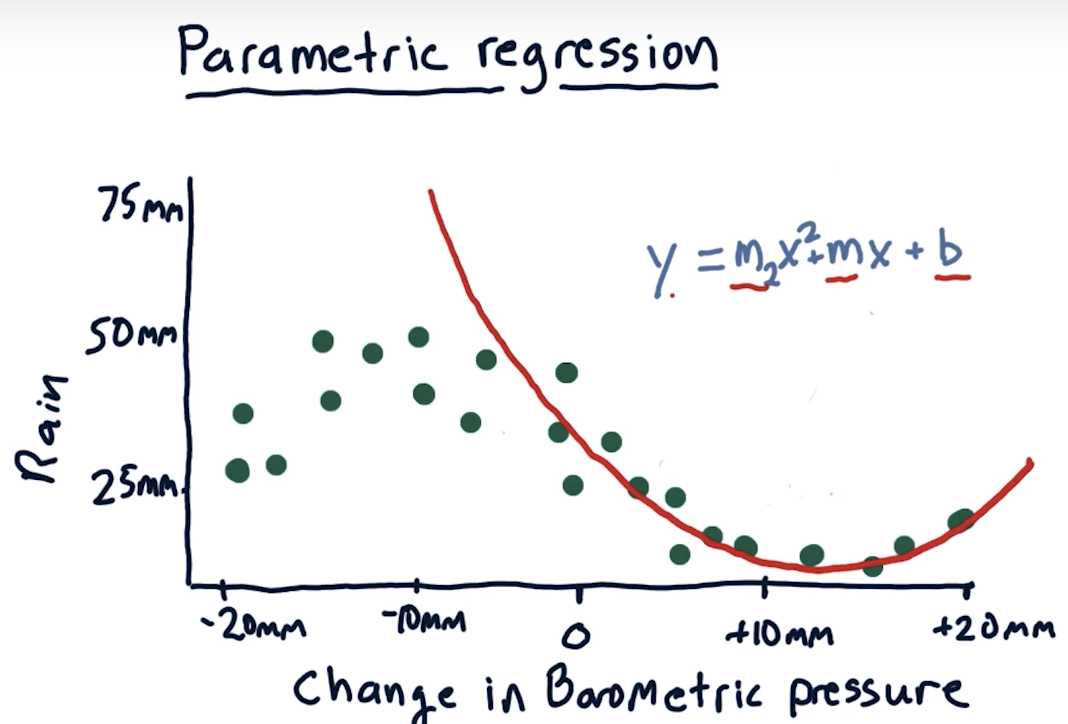

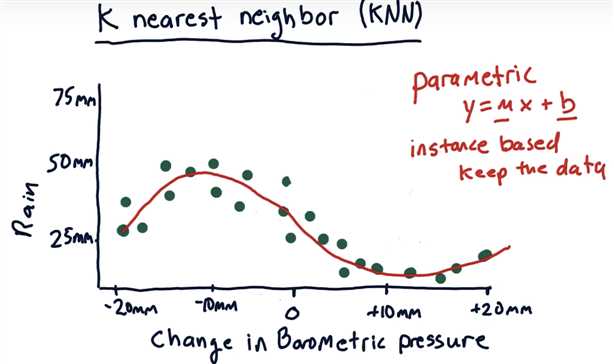

Parametric regression

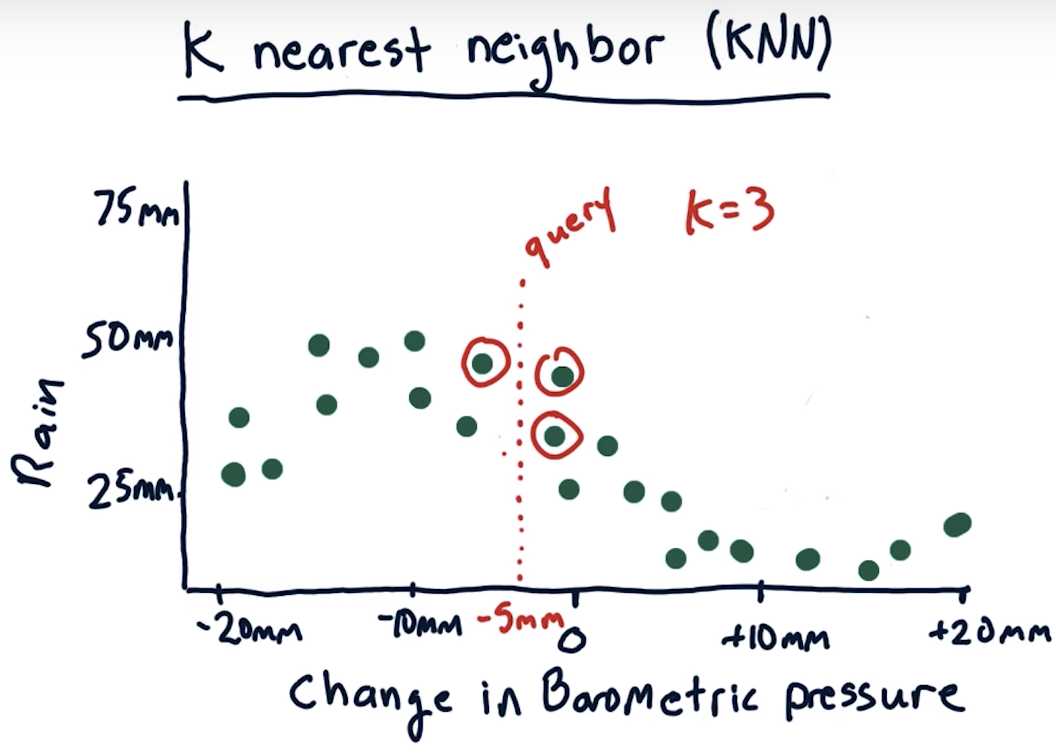

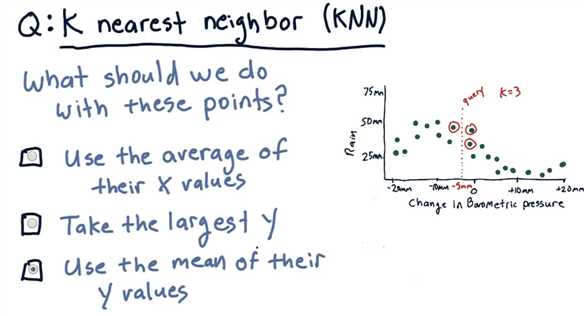

K nearest neighbor

How to predict

Kernel regression

Kernel regression is different from KNN, because it uses kernel to weight the contribution of each nearest point

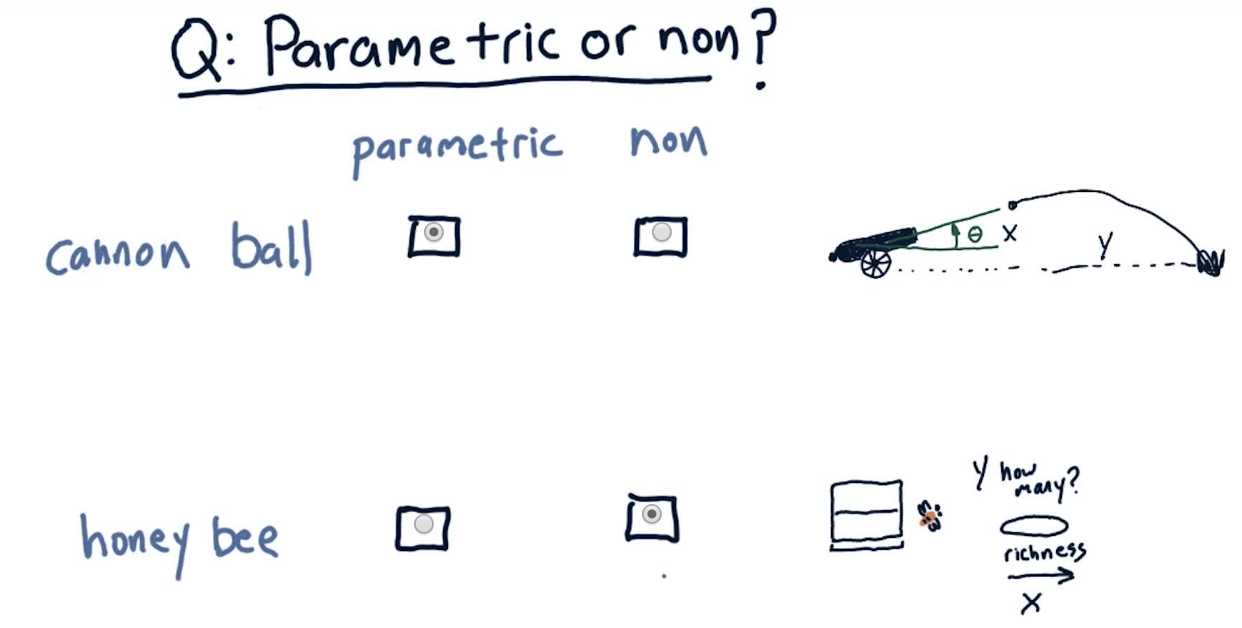

Parametric vs non parametric

Yes, the cannon ball distance can be best estimated using a parametric model, as it follows a well-defined trajectory.

On the other hand, the behavior of honey bees can be hard to model mathematically. Therefore, a non-parametric approach would be more suitable.

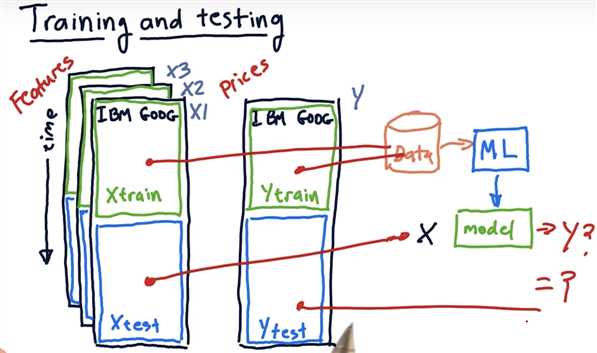

Training and testing

typically: train on older data; test on newer data

look ahead bias occurs if training reversely

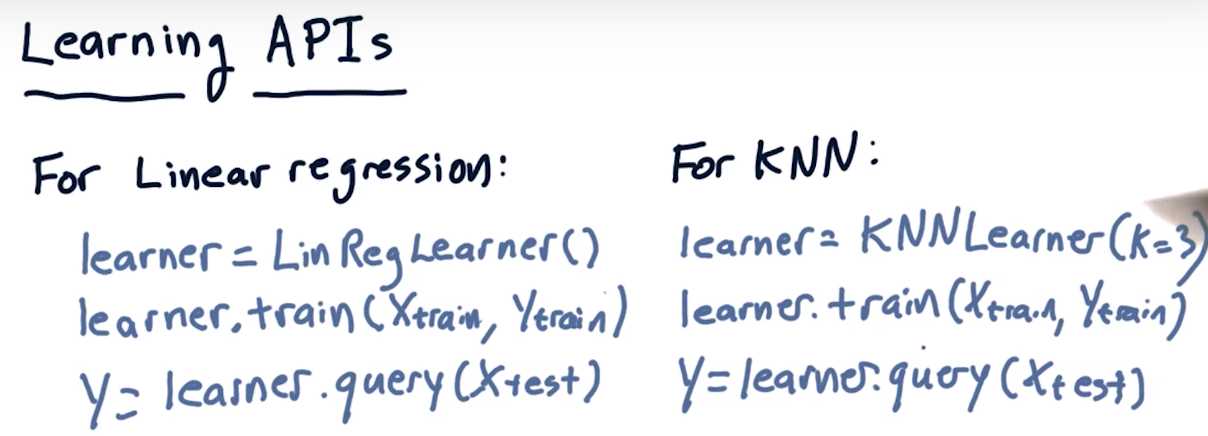

Learning APIs

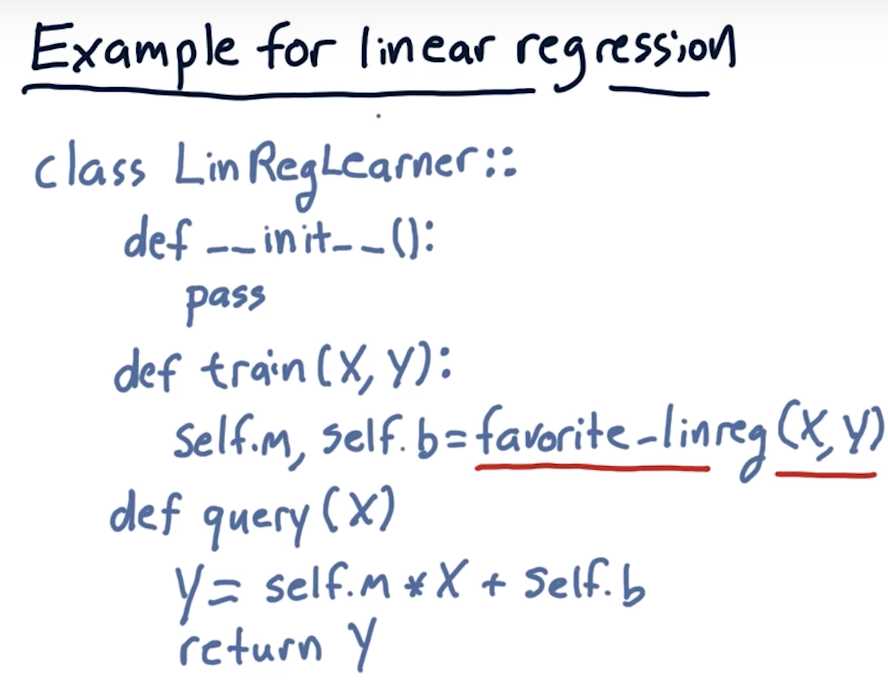

Example for linear regression

Note: This is intended to be pseudo-code only, although some Python-specific syntax has been shown.

以上是关于[Machine Learning for Trading] {ud501} Lesson 21: 03-01 How Machine Learning is used at a hedge fund的主要内容,如果未能解决你的问题,请参考以下文章

[Machine Learning for Trading] {ud501} Lesson 21: 03-01 How Machine Learning is used at a hedge fund

机器学习- 吴恩达Andrew Ng 编程作业技巧 for Week6 Advice for Applying Machine Learning

Advice for students of machine learning