[Machine Learning for Trading] {ud501} Lesson 19: 02-09 The Fundamental Law of active portfolio mana

Posted ecoflex

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了[Machine Learning for Trading] {ud501} Lesson 19: 02-09 The Fundamental Law of active portfolio mana相关的知识,希望对你有一定的参考价值。

this lesson => Buffet said two things

=> (1) investor skill

=> (2) breadth / the number of investments

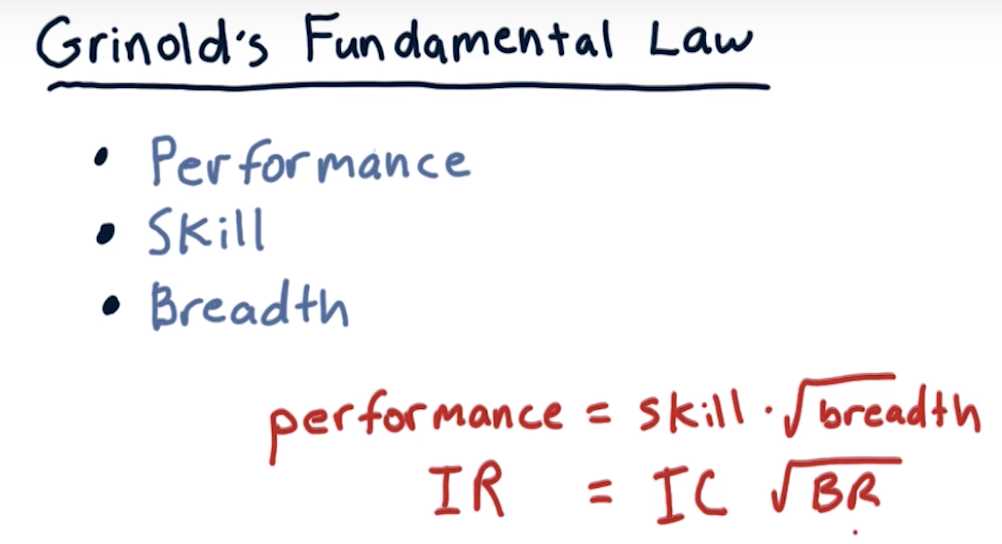

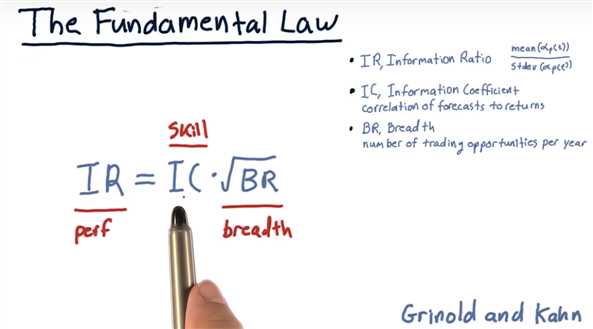

Grinold‘s Fundamental Law

breadth => more opportunities to applying that skill => eg. how many stocks you invest in

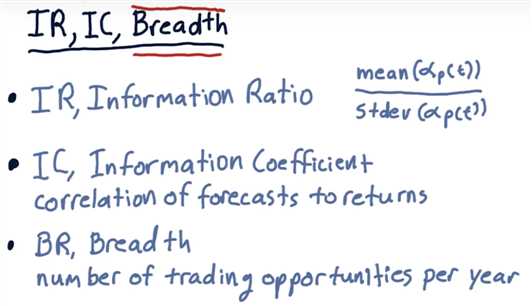

IC => information coefficient

BR => breadth / how many trading opportunities we have

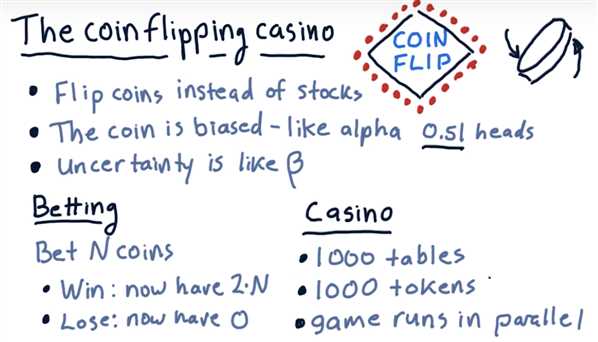

The Coin Flipping Casino

Which bet is better?

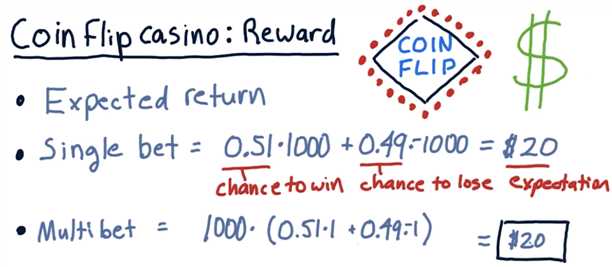

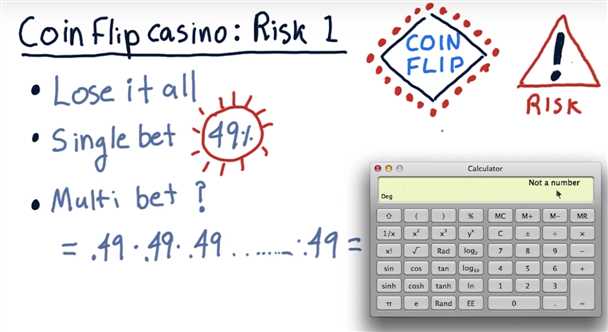

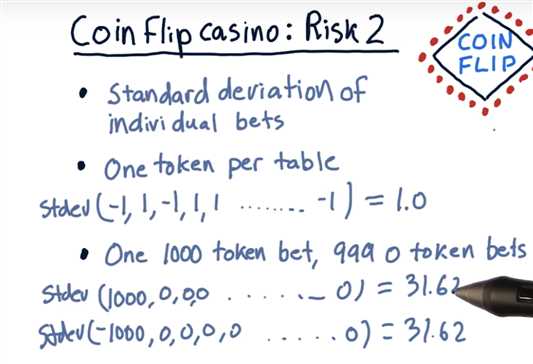

Coin-Flip Casino: Risk

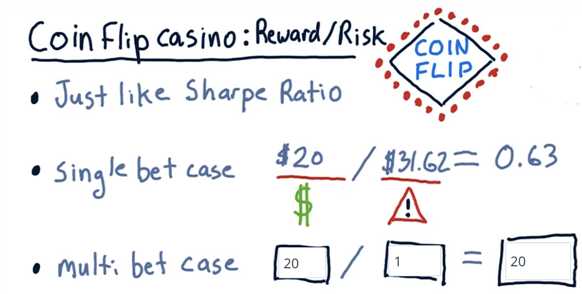

Coin-Flip Casino: Reward/Risk

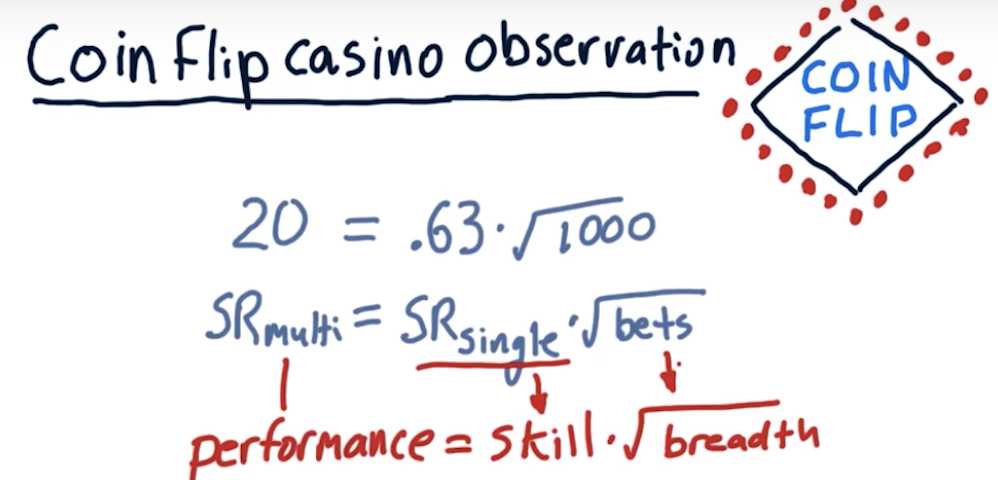

Coin-Flip Casino: Observations

Coin-Flip Casino: Lessons

(1) higher alpha generates a higher sharpe ratio

(2) more execution opportunities provides a higher sharpe ratio

(3) sharpe ratio grows as the square root of breadth

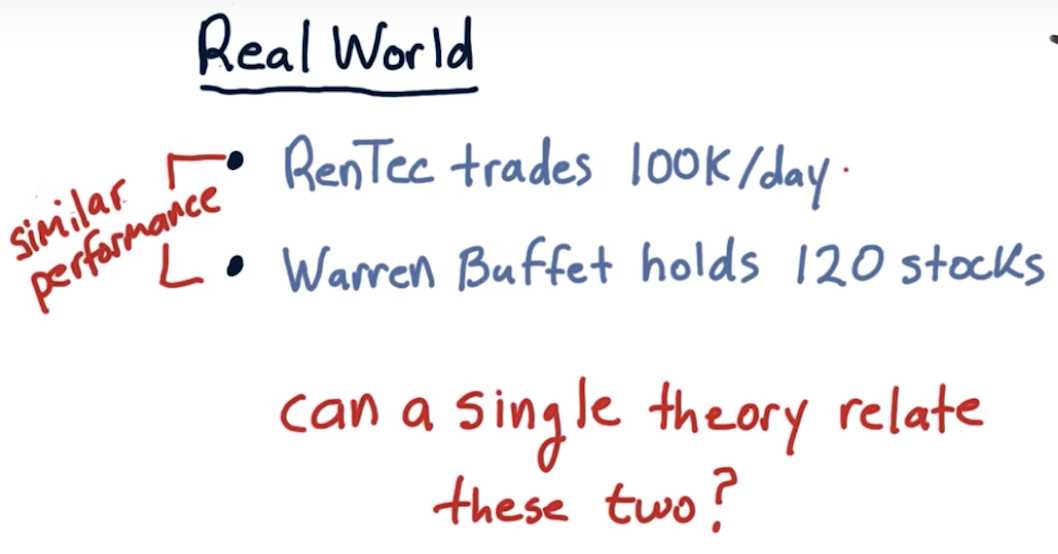

Back to the real world

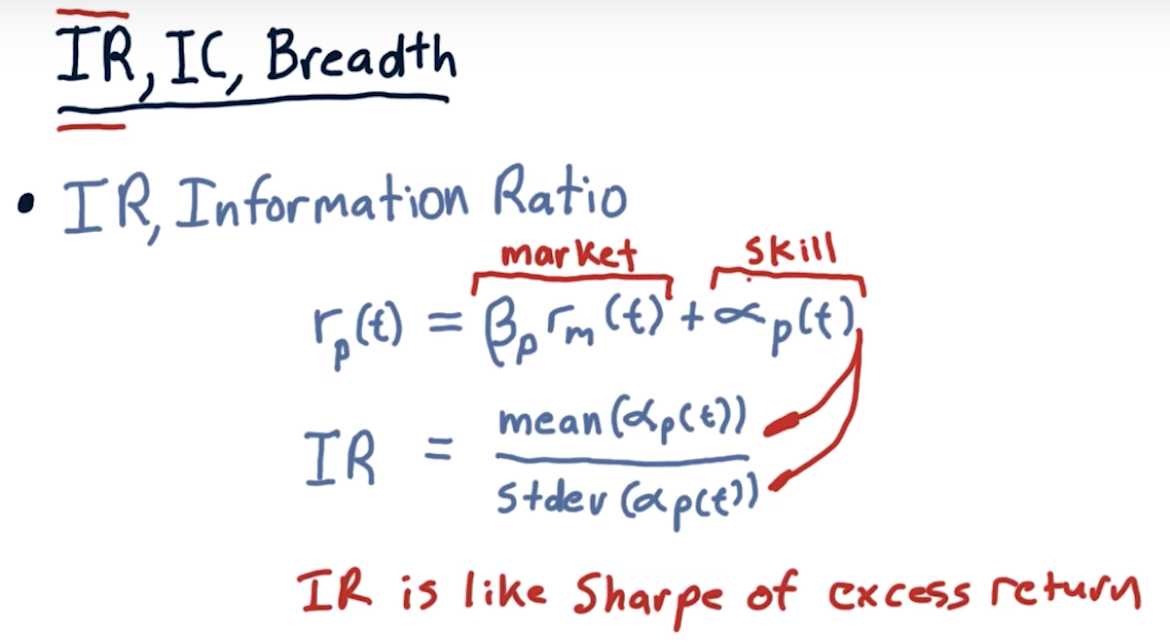

IR, IC and breadth

The Fundamental Law

skill is harder to be increased than breadth

Skill => introverted

Breadth => extroverted

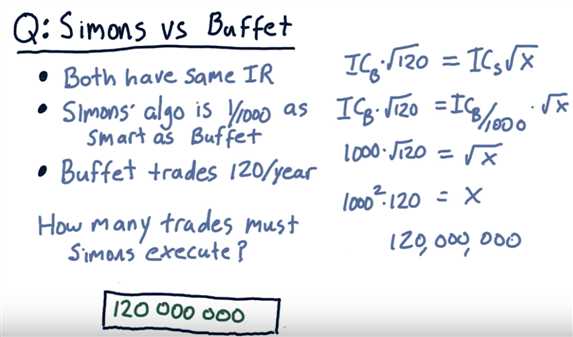

Simons vs. Buffet

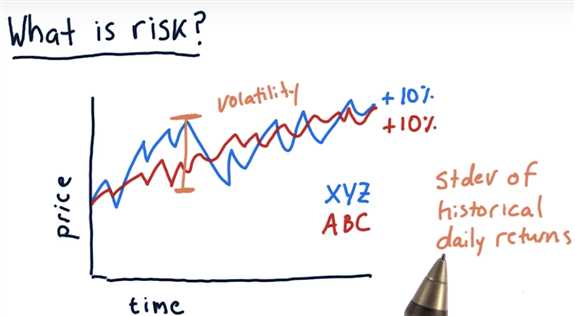

What is risk?

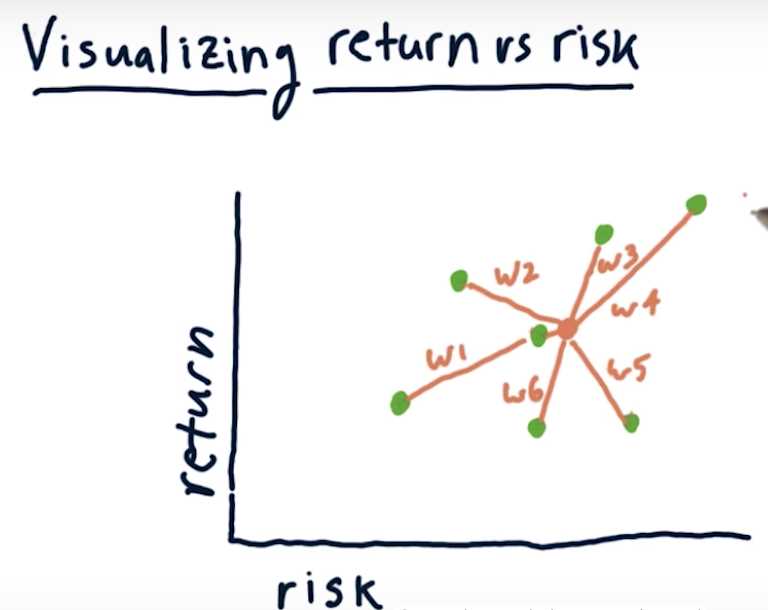

Visualizing return vs risk

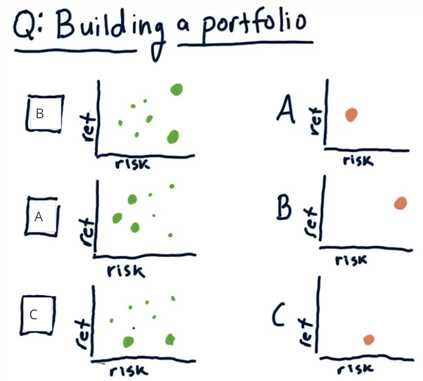

Building a portfolio

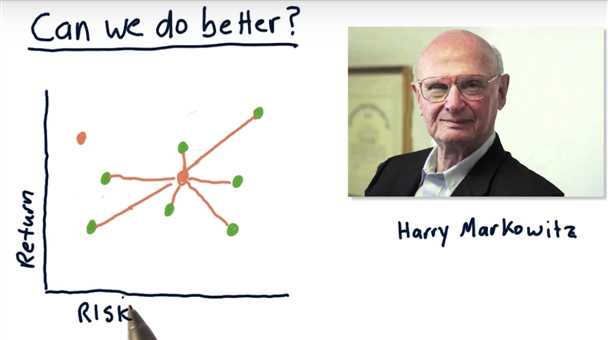

Can we do better?

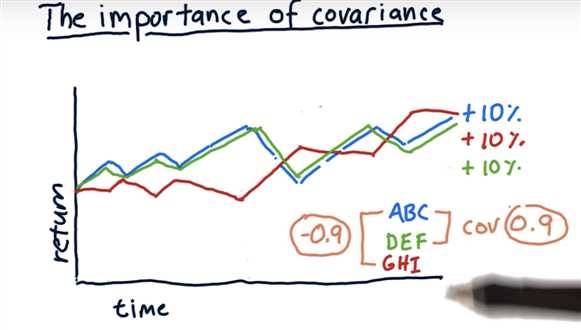

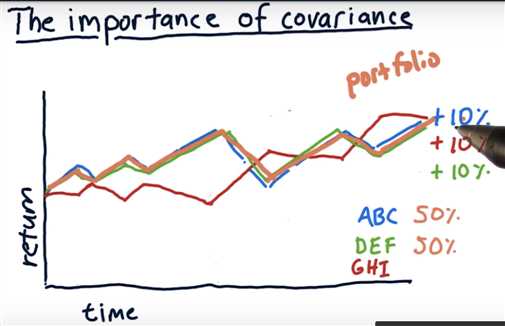

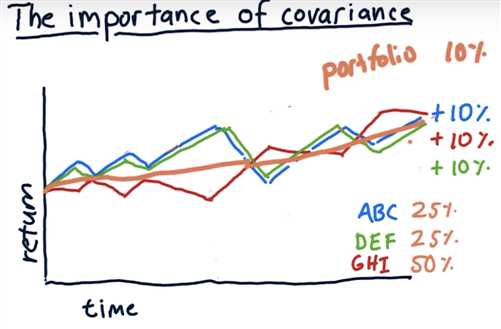

Harry discovered the relationship between stocks in terms of covariance

resulting of the portfolio is not just a blend of the various risks

right stocks picking => outliers

Why covariance matters

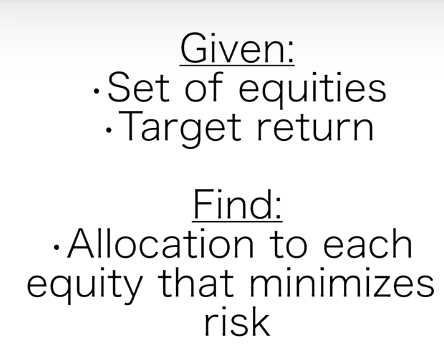

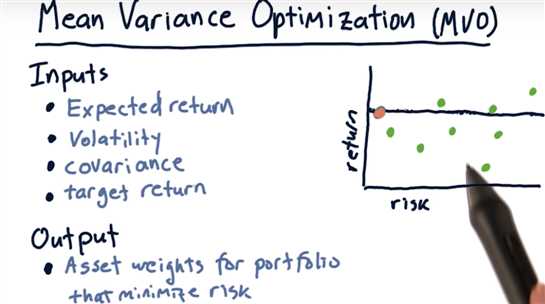

Mean Variance Optimization

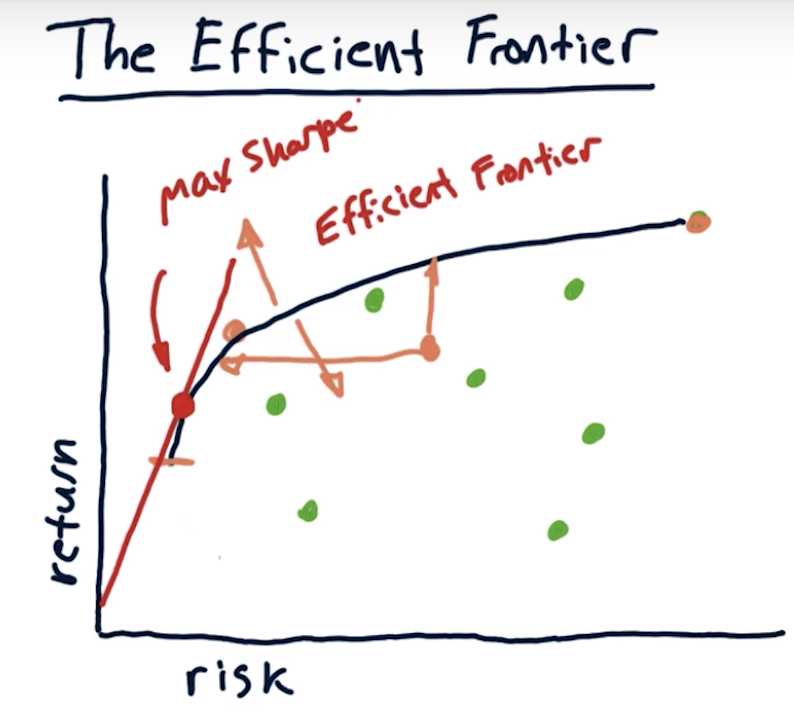

The efficient frontier

以上是关于[Machine Learning for Trading] {ud501} Lesson 19: 02-09 The Fundamental Law of active portfolio mana的主要内容,如果未能解决你的问题,请参考以下文章

[Machine Learning for Trading] {ud501} Lesson 21: 03-01 How Machine Learning is used at a hedge fund

机器学习- 吴恩达Andrew Ng 编程作业技巧 for Week6 Advice for Applying Machine Learning

Advice for students of machine learning