Three waves of Blockchain Revolution in Finance

Posted DRC金融科技资讯

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了Three waves of Blockchain Revolution in Finance相关的知识,希望对你有一定的参考价值。

Author: 8 Decimal Capital Research, Ran Wei

Translation: @BlockArk

Editors: 8 Decimal Capital Research,Kadeem Clarke, Brian Hough, Alec Pippas, Zoe Qian

This article is based on the recently published research conducted by our Chinese research team which received 800,000+ views across many Chinese media networks. The original article can be viewed .

Part 1: Payments and 1COs

8 Decimal Capital Overview:

There will always be a new societal paradigm after the establishment of each technological wave of innovation.

When the technological wave arrives, the initial hype will result in a “bubble” which can price market assets at a higher valuation than they are currently worth. This occurs until technology becomes ingrained in society with a consistent market value.

Blockchain is not only a technological innovation, but it is also a change in the way consumers and future businesses interact with one another in a more secured and integrated world.

I.The First Wave:

Payment and Transactions

Throughout the life of blockchain, the industry has experienced several waves of popularity, including several bull and bear markets for cryptocurrencies.

The first wave started with payment & transactions when Bitcoin and other cryptocurrencies became popular payment tools. These new currencies disrupted the payments space, which previously only worked using traditional fiat currencies.

On January 3, 2009, Satoshi Nakamoto left one sentence in the Bitcoin Genesis Block: “ The Times of London | 01/03/2009 | Chancellor on Brink of Second Bailout for Banks.” This is the headline of The Times on that same day when the British Chancellor of the Exchequer was forced to consider a second attempt to relieve the banking crisis. Bitcoin, born after the 2008 economic crisis, echoed people’s discontent with the traditional financial system, launching a new wave of “decentralized” thinking.

Pictured above is “The Times” article which Satoshi Nakamoto wrote into the Bitcoin Blockchain Genesis. (Source)

Pictured above is “The Times” article which Satoshi Nakamoto wrote into the Bitcoin Blockchain Genesis. (Source)

II. The Second Wave: Equity and Financing

The second wave was equity and financing, when 1COs became the new means of financing blockchain projects.

During the 2017 bull market, token investments gave venture capital funds an exit opportunity providing a high liquidity and rate of return. In 2017, projects could receive funding through an 1CO with just a white paper and promotion from Twitter influencers. Their token would get listed quickly on an exchange with relative ease. Sophisticated investors and crypto enthusiasts alike from all around the world could invest in their tokens by simply signing up with a crypto exchange, transferring crypto to their accounts, and making the trade. The catch was that these tokens and the entire 1CO process are unregulated. The lack of regulation gave opportunities to scam projects to sell worthless tokens to mislead investors.

Amid the regulatory uncertainty, 1COs surged due to getting funding from many hyped investors. As a result, a hundred times return on an investment became “reasonable,” giving cause to the “bubble.” In the later half of 2017, 1COs were on the radar of the SEC after many investors lost money on fraudulent projects. The regulatory body deemed 1COs as a security offering, thus subject to securities laws. On September 4, 2017, China decided to shut down domestic exchanges and ban 1COs. However, the global market cap for all cryptocurrencies had already reached over $160 billion. Many people hoped that investing in these 1CO projects could make them money while also speeding the growth of FinTech.

At the beginning of the FinTech movement, Shengxi Huang, the founder of New Money, pointed out that “FinTech will not exist in the world if the traditional financial system is effective and balanced. Nowadays, the traditional financial world is full of bureaucracy and inefficiencies. However, for FinTech to be accepted by the public, it needs to bring efficiency and equality.”

Today, China is experiencing a downward economic cycle with soaring debt, shrinking balance sheets at the central bank, increasing currency control, and a destructive trade war. In fact, it is not only China: the global macroeconomic turmoil and the prices of cryptocurrencies are becoming inversely correlated. According to BlockVC’s strategy research, since Venezuela’s issuance of the Petro Coin, cryptocurrencies have come into consideration as an increasingly popular means for emerging market countries to ease their national currency and debt crises.

With the decline of global cross-border capital investments, the fiat currencies of Turkey, Brazil, Argentina, South Africa and other countries have sharply depreciated, causing economic turbulence. More importantly, due to the effects of globalization, all economies are intertwined. When economic markets experience decline, these effects are negatively felt elsewhere causing further financial volatility.

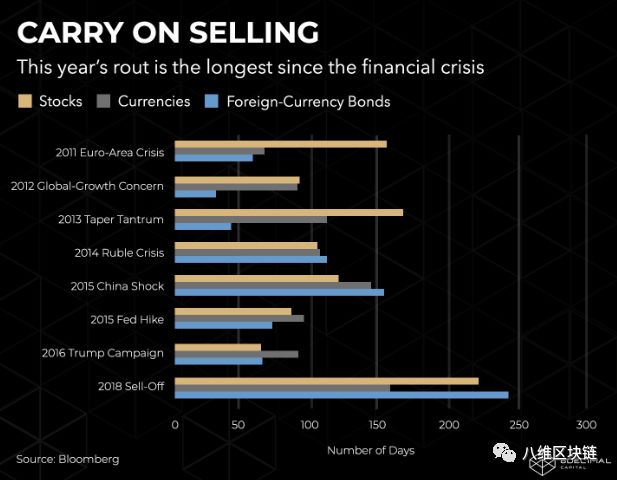

As reported by Bloomberg, the current emerging market rout is the longest stretch since 2008. Bloomberg researched the number of days following a downward trend, how long it takes people before they stop selling their stocks and begin buying stock again. In 2018, stocks have seen carry on selling for 222 days, currencies for 155 days and local government bonds for 240 days. (Source)

As reported by Bloomberg, the current emerging market rout is the longest stretch since 2008. Bloomberg researched the number of days following a downward trend, how long it takes people before they stop selling their stocks and begin buying stock again. In 2018, stocks have seen carry on selling for 222 days, currencies for 155 days and local government bonds for 240 days. (Source)

Contrary to the traditional financial markets, blockchain and cryptocurrencies are global by nature. Cryptocurrencies face global markets with tens of thousands of exchanges. However, different governments have their own attitudes toward cryptos, making consortium agreements between multiple countries difficult. Many projects have taken advantage of this by obtaining legal and compliance documents from policy-friendly countries, such as Singapore and Switzerland. For example, projects can be registered in Singapore, receive capital from venture funds that are registered in Switzerland and Cayman, then become listed on exchanges in Malta due to the 1CO-friendly policies of these countries.

In response to the aforementioned global policy phenomenon, Tim Draper, a prominent American venture capitalist, said that the most exciting feature of Bitcoin is that it is a global currency. Governments will become public service providers that need to compete openly, rather than being monopolies of specific regions.

In the future, governments will act as service providers for their customers: the citizens.As citizens, people can choose the products they buy and the businesses they choose to work with in certain cities. As such, governments will have to compete amongst each other with regulation and legislation. 1CO businesses will flow, as a result, to the markets with government service providers which are most amenable to their development. Because of the nature of this industry, countries, especially small countries, will have a FOMO (Fear of Missing Out) effect. They will not want to miss the opportunity to grow their economy, so these emerging markets will be more likely to set up more blockchain-friendly policies.

Since innovation always comes before regulation, people can financially benefit from this critical time period by making strategic investments into this innovative technology. With an ever growing influx of projects, the supply of capital in this industry is insufficient. When the supply of projects exceeds investment demand, according to the rule of supply and demand, a large number of token prices will inevitably collapse. This has been seen in the most recent 1CO market correction. Good timing and thorough due diligence are key to investing in the blockchain space.

The early adopters of the next revolution can often profit from investing early. However, when the revolution becomes overhyped, bubbles form. Consequently, late adopters and imitators often face substantial losses. Such was the outcome in 2018. In order to survive the speculative conditions and control losses, projects generally began to sell their depreciated ETH from financing. This had a cascading effect and was one of the principal impetuses to the collapse of the price of ETH and other cryptocurrencies. We are in a transitioning period right now: the “trash coins” are not entirely cleared out of the market and new funds haven’t decided to enter the market. It is likely the market will continue this bearish state for the time being until a new catalyst arises, possibly regulation.

The inflection point initiating new trends will appear only when blockchain-related assets are incorporated or opened to a larger, institutional market.

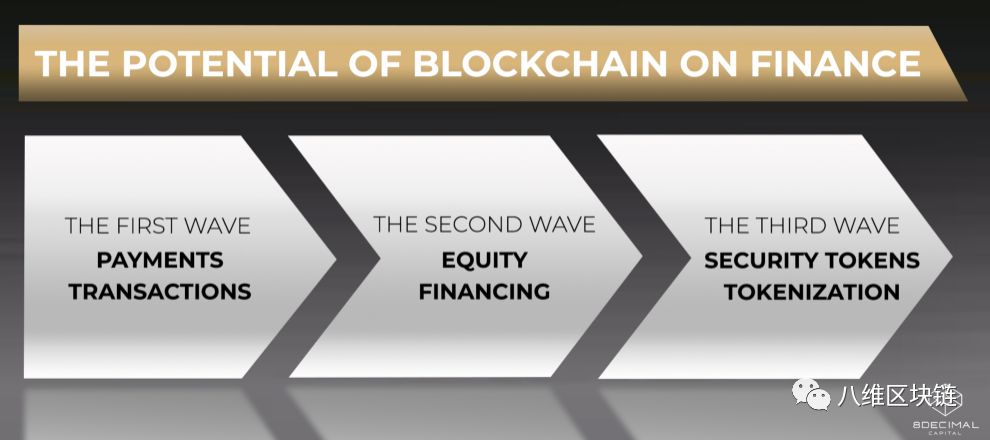

From the first wave of payments to the second wave of equity financing, unique technology has been developed from the infrastructure level and up. The first wave, payment and transactions, gave birth to wallets and secondary market platforms. The second wave, equity financing, brought forth a digital version of investment banks to provide investment, underwriting, market making, refinancing and a package of services such as rating, research and other offerings to mirror the traditional financial services industry.Combining the efficiency of a new age of digital investment banks with regulated tokens leads into the third wave of blockchain in finance.

As we continue to build the blockchain ecosystem, we see a high potential and yield for this new third wave of financial evolution.

Part 2: Security Tokens (STs)

8 Decimal Capital Overview:

In 2017, the global value of equity assets totaled $70 trillion, debt totaled $100 trillion, and the real estate market totaled $230 trillion.

If all of these markets became tokenized, the potential size of the security token (ST) market would skyrocket.

The major changes STs bring to the world include: programmable and automated compliance, rapid settlement, fractional ownership, asset interoperability, and increased liquidity and market depth, among many other key advantages.

The benefits of blockchain are intrinsic to the technology. However, the process of accelerating the mainstream adoption of these solutions is slowed by the natural skepticism around new technologies. As 8 Decimal Capital works to accelerate the mainstream adoption of the full value of blockchain technology, we have taken a special interest in investing in projects that are building the infrastructure for the future Security Token market. As shown in the graphic below, Security Token Offerings (STOs) are the third wave of blockchain technology.

Within the digital transformation of finance, three waves have emerged. The first with payments and transactions, the second with equity and financing, and the third wave is where tokenization and security token offerings offer a great amount of potential.

In China during March of this year, Yuan Dao et al. put forward the concept of “Tokenization” in Token is the Key to the Next Generation Internet Digital Economy. It is defined as encrypted digital proof of rights and ownership. “It’s to provide token holders with all kinds of rights and interests, such as tickets, points, contracts, certificates, securities, authority, qualification, so called tokenization. When it’s put on the blockchain for circulation or put on the market to trade, let the market find its price, while in the real economic life can be consumed.”

Thoughts of a tokenized world have led to the creation of security tokens (STs) and Security Token Offerings (STO). According to Josh Stein, CEO of Harbor, “A security token represents traditional, private security interest…Essentially, you’re taking something that today you have on paper and you’re putting an electronic wrapper around it.”

In 2017, the estimated global value of equity assets totaled $70 trillion, debt totaled $100 trillion, and the real estate market totaled $230 trillion. If all of these markets became tokenized, the potential size of the security token market would be beyond imagination.

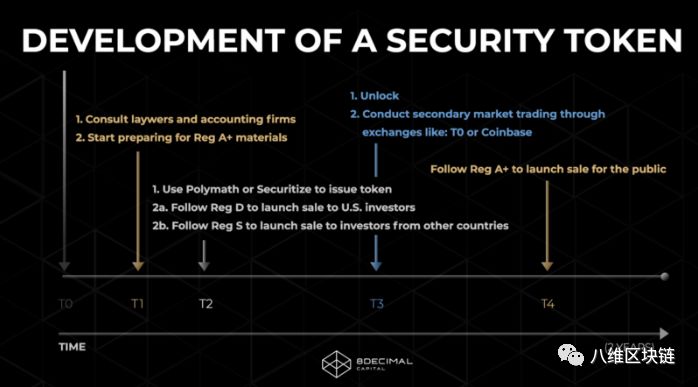

Understanding the regulations required to launch a security token to the market is paramount to the STO’s success. The chart above shows the process over the span of two years.

Understanding the regulations required to launch a security token to the market is paramount to the STO’s success. The chart above shows the process over the span of two years.

What exactly is a security token (ST)? What are its strengths and weaknesses? In the future, will STs really lead a new wave of digital assets?

When people originally would speak about security tokens, they related STs almost exclusively to utility tokens. In order to avoid regulation, some projects often claimed that they only launched utility tokens, which solely acts as a mode of accessing a platform or services, implying their tokens are not securities. However regulators seem to disagree with this logic. When the regulations are applied to STs, the regulatory bodies will adopt the principle of “substance is more important than form.” So it doesn’t matter how you name the tokens, it’s more about if your tokens have the same functions as securities.

When deciding whether or not a token is a security, there are two main questions to consider:

a)Is this token a stock, bond, or any other form of equity or debt instrument?

b)Does this token pass the Howey Test?

The latter, the definition of investment contracts, is derived from the 1946 Howey Test. This legal test, resulting from a series of court decisions beginning with SEC v. Howey, qualifies certain transactions as securities using four criteria. At the Atlantic Panel Meeting of the SEC, the Commission proposed that “if a token can satisfy the Howey Test of an investment contract, it will be deemed to be a security. It will be declared a functional one if it is used only within the platform after pre-sale and does not enter secondary market markets.”

Security tokens maintain the regulation of analogue securities while also providing the efficiency of a digital security. According to Security Token Academy’s The Five Dimensions of Security Tokens-The Third Wave of a New Financial Internet, there are two types of security tokens from a legal point of view:

a)ST 1.0 — The first generation of STs are regulated token products. In the US all securities must be registered with the SEC unless they qualify for exemption. Security tokens apply regulatory frameworks to digital tokens, mainly using exemptions (Regulation S, Regulation A+, and Regulation D). Regulation D and Regulation S exemptions, applicable to US securities, allow for raising funds without registering with the SEC. Reg D is covers private equity law, Reg S deals with US companies with overseas investors, and Reg A+ is equivalent to mini IPOs, requiring two years of audited financial information.

b)ST 2.0 — The second generation of STs are ones that simplify the process used to verify assets and investors. This means to simplify the process of KYC (Know Your Customer) and AML (Anti-Money Laundering) filing using smart contracts. By integrating the regulatory rules of different countries into smart contracts, it will become more easier to conduct cross-border transactions.

Tatiana Koffman explains STs and their key features in her research article, “ Your Official Guide to the Security Token Ecosystem”:

a) A ST is a type of digital asset regulated by federal securities laws and regulations. Simply speaking, it lies at the intersection of digital assets and traditional financial products.

b) STs have programmable ownership. If Bitcoin is dubbed as the “programmable currency”, then STs can be dubbed “programmable ownership”. Any ownership assets can and will be tokenized.

Based on the information mentioned above, there are two driving forces to strengthen the adoption of STs:

First, reduce investor risk and strengthen due diligence. In the context of the United States, enacting securities regulation and regulatory exemptions, such as Reg D or Reg S, is the first step towards compliance. In the ST 2.0 era, programmable compliance will be incorporated to facilitate KYC and AML provisions into smart contracts.

Second, global investors always seek higher liquidity, rate of return and alpha. STs are expected to reduce the barrier to investment in global assets. The ease of investment will result in a potential liquidity premium. “The new security token market will support the ongoing trend of globalization,” says Kadeem Clarke, Investment Manager at 8 Decimal Capital, “with the flexibility of blockchain technology. Investors around the world will have an easier way to safely invest in the assets of foreign markets while maintaining liquidity.”

Liquidity and a global investor base are two key benefits of STs. If Chinese Internet companies want to return to an exchange in another region, they have to go through the process of privatization and delisting, dismantling the VIE structure, and then entering the IPO queue or backdoor. A similar degree of inefficiency also occurs in private markets.

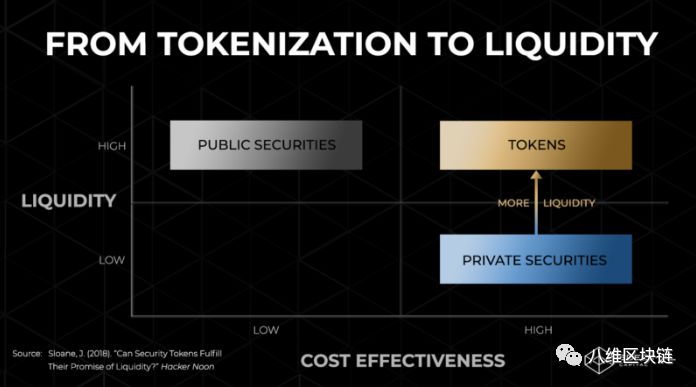

Most private assets are illiquid and have high transaction costs. With private assets such as venture capital or private equity investment, exiting your positions before the liquidation of the fund often entails substantial costs. Blockchain offers a solution to this liquidity problem. By transforming these assets into a ST, lock-in periods can be reduced and liquidity can increase from a global pool of investors.

Tokens provide the cost effectiveness of private securities while maintaining the liquidity of public securities. (Source)

Tokens provide the cost effectiveness of private securities while maintaining the liquidity of public securities. (Source)

To sum it up, the major changes STs bring to the world include:

Programmable and Automated Compliance and Rapid Settlement: STs need the approval and permission of regulatory authorities to automate KYC/AML and achieve instant clearing.

Fractional Ownership: STs streamline the division of property ownership and reduce the entry threshold of high-risk investment products, such as real estate and high-end works of art.

Asset Interoperability: The Internet is essentially a bunch of protocols that enable many different types of software to exchange and utilize information (TCP/IP, SMTP, FTP, SSH, HTTP). A standardized agreement on assets will facilitate interoperability between heterogeneous assets and different regulatory bodies.

Liquidity and market depth: You can invest in illiquid assets through STs without fear of redemption, and the market depth will increase through the following:

1) The rise in the price of digital assets creates billions of dollars of incremental wealth that will be invested in the market.2) A Bancor-like procedural market maker to improve the liquidity of long tail assets.3) Asset interoperability agreements to facilitate cross-border asset flows.

However, technology is by no means omnipotent. The free flow of global trade and capital depends not only on technical factors but more on international politics, financial policies and institutional arrangements. For financial innovation, improved efficiency is less prioritized than controlling risks, such as:

a. Excessive liquidity of assets bringing huge price fluctuations.

For startups, it often takes a long time to launch an IPO. It takes even more time for their stocks to be substantially liquid. However, STOs can enable startups to be listed on an exchange quickly, obtaining investments from all corners of the globe. Concerningly, startups often face a lot of uncertainties, both positive and negative. These uncertainties coupled with a highly liquid global market can cause volatility in token prices. Consider how Elon Musk’s one Tweet caused a plunge in the Tesla share price. Similar reactions to security token-funded project executives can become common.

b. Financial innovation may just accumulate risks to the tail.

According to Bengt Holmstrom, “everything that adds to liquidity in good times pushes risk into the tail.” Mainly, the core function of financial institutions as intermediaries is to configure the risk structure of each entity. During the 2008 financial crisis, many shadow intermediaries in the value chain of real estate appeared to be valuable with complex financial instruments. However, in reality, these complex instruments covered up liquidity, term, and credit risks which made risk pricing inaccurate and ultimately became a catalyst for the irrational rise in real estate asset prices.

c. Asset securitization and Tokenization requiring comprehensive and costly development.

The definition of a security token reminds us of securitization in traditional finance. Securitization refers to the packaging of assets with future cash flows into asset pools, the structured design of cash flows generated by asset pools, and the conversion of low-liquidity assets into high-liquidity asset-backed securities (ABS).

What is the difference between security tokens and traditional asset securitization? What is the connection between STOs and IPOs?

In the next article about security tokens, we will address these and other pressing questions on the security token industry.

Part 3: Investment Thesis Update

8 Decimal Capital Overview:

Participating in an unregulated ICO, is risky and volatile:“ICO Terms state that the project is a high-risk investment and it might fail.”

STOs, on the other hand, are providing a new form of fundraising and financing with properties similar to an Initial Public Offering, or private equities.

STOs provide investors with more flexibility and efficiency, including the ability to issue security tokens or asset-backed IOUs which are legal in nature for providing investors with “access to shares of a company, a monthly dividend or a voice in the business decision-making process.”

The Warren Buffett approach of thinking long-term with the fundamentals is paramount to successful investing in the blockchain space. According to a 2018 report by Statista Inc., the global market for blockchain technology is predicted to reach a market cap of $548.2 million in 2018 and eventually a $2.3 billion market cap by 2021. 8 Decimal Capital is interested in companies using this technology to enact meaningful change rather than using blockchain as a buzzword. As we build the blockchain ecosystem through venture capital investment, we are especially interested in companies that combine blockchain and cryptocurrency technologies with a powerful and compelling use-case.

Through a comprehensive due diligence analysis focused on three core business areas — underlying technology, management team, and industry sector outlook — 8 Decimal is committed to building the blockchain industry with a foundation-first investment approach.

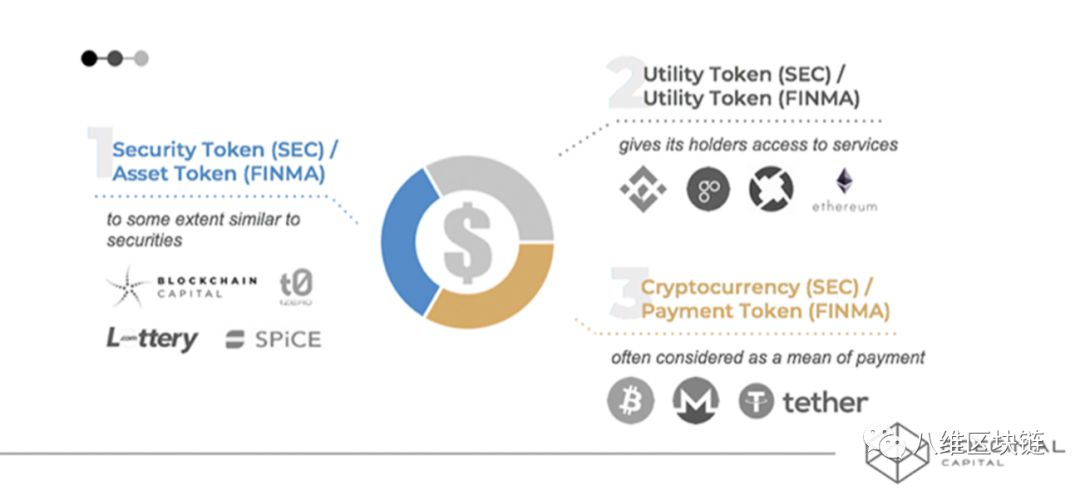

Security Token & Asset Token | Utility Token | Cryptocurrency & Payment Token

New technologies begin with one proven use-case and expand throughout the market following the success of this original use-case. Technology giants such as Google (Google Developers) in the search engine field, Alibaba (Alibaba Tech) in the e-commerce field, Meituan in the O2O field, Didi in the sharing economy field, and Bitcoin in the cryptocurrency field all started with a single use-case either as a product or service. Once these use-cases were proven in the market, they were rapidly expanded into a whole suite of products and services. Within a highly competitive market economy, these companies oversaw an immense digital transformation and evolution of their original use-cases. In the blockchain world, this has been seen in the three waves of development:

Payments and transactions (Cryptocurrencies)

Equity and financing (ICOs)

Security tokens and tokenization (Digital assets)

One of the specific areas of blockchain technology that 8 Decimal Capital is quite bullish on is the Security Token space. There is an opportunity for Security Tokens to drastically change the traditional financial industry. Security Token Offerings (STOs) are considered to be a new and improved Initial Coin Offering (ICO).

As LindaCrypto and Hackernoon report that participating in an unregulated ICO is risky and volatile, “ICO Terms state that the project is a high-risk investment and it might fail.” STOs, on the other hand, are providing a new form of fundraising and financing with properties similar to an Initial Public Offering, or private equities, where “a company issues security tokens to investors [or] asset-backed IOUs and can be considered legally binding investment contracts that give investors access to a share of the company, a monthly dividend or a voice in the business decision-making process.”STOs provide investors with more flexibility and efficiency. As the value that STOs can provide to investors and companies is still being created, 8 Decimal Capital remains bullish on the value these processes can bring to the blockchain and cryptocurrency industry in the near future.

We believe that industry players, venture capital funds, and related capital providers will maintain the desire to assist in progressing the digital world. 8 Decimal Capital is looking for an evolution rather than a revolution: to change the analogue world into a hybrid digital world instead of directly going into a purely digital world. This hybrid world combines the traditional business world with new technology without completely replacing current business structures. This will allow for steady and sustainable growth of blockchain technology.

8 Decimal Capital has realized that successful investment is the result of building a foundational groundwork. We invest in public chains and protocols to help build up the infrastructure layer. Eventually, we expect infrastructure layer technologies to be leveraged in the creation of dApps and consumer-facing applications. In addition to investment at the infrastructure layers, we have invested in the blockchain financial ecosystem too. Investments have been made in exchanges, stable currencies, Security Token service providers, payment platforms, and lending platforms. We form strategic alliances with many exchanges, media outlets, consultancy services, and developer communities to support our investment portfolios with resources and a powerful network.

Through prioritizing a full-ecosystem investment strategy, 8 Decimal Capital is shaping the blockchain future by supporting pathways for the old and new business worlds to take full advantage of blockchain’s potential.

加入DRC社区

享尊贵身份

期待你的到来~

长按二维码入群

以上是关于Three waves of Blockchain Revolution in Finance的主要内容,如果未能解决你的问题,请参考以下文章

Gym 101666K King of the Waves(dfs)