Python笔记-CAPM(资本资产定价模型)例子

Posted IT1995

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了Python笔记-CAPM(资本资产定价模型)例子相关的知识,希望对你有一定的参考价值。

数据是这样对应的

| 沪深300 | 000300.SH.csv |

| 茅台 | 600519.SH.csv |

| 平安 | 601318.SH.csv |

如下代码:

# -*- coding: utf-8 -*-

import pandas as pd

import statsmodels.api as sm

if __name__ == '__main__':

hs300 = pd.read_csv("000300.SH.csv", index_col="date")

maoTai = pd.read_csv("600519.SH.csv", index_col="date")

pingAn = pd.read_csv("601318.SH.csv", index_col="date")

stock_list = [maoTai, pingAn, hs300]

df = pd.concat([stock.pctChg / 100 for stock in stock_list], axis=1)

df.columns = ["maoTai", "pingAn", "hs300"]

df = df.sort_index(ascending=True)

print(df.describe())

# 填充数据

returns = (df + 1).product() - 1

print('累计收益率\\n', returns)

# 假设无风险固定收益为3.2%,那么平均每日的无风险收益率为

rf = 1.032 ** (1 / 360) - 1

print("平均每日的无风险收益率为: ", rf)

# 茅台或平安 和 沪深300各自的风险溢价

df_rp = df - rf

stock_names =

'pingAn': '中国平安',

'maoTai': '贵州茅台'

for stock in ["pingAn", "maoTai"]:

model = sm.OLS(df_rp[stock], sm.add_constant(df_rp['hs300']))

result = model.fit()

print(stock_names[stock] + '\\n')

print(result.summary())

print('\\n\\n')

pass运行如下:

D:\\python\\content\\python.exe D:/PythonProject/demo/demo22.py

maoTai pingAn hs300

count 243.000000 243.000000 243.000000

mean 0.000420 -0.001960 -0.000151

std 0.023567 0.016815 0.011708

min -0.069911 -0.054476 -0.035325

25% -0.012650 -0.011324 -0.006741

50% 0.000323 -0.003655 0.000398

75% 0.014569 0.004840 0.006918

max 0.095041 0.077337 0.031595

累计收益率

maoTai 0.035688

pingAn -0.399967

hs300 -0.051986

dtype: float64

平均每日的无风险收益率为: 8.750012529978868e-05

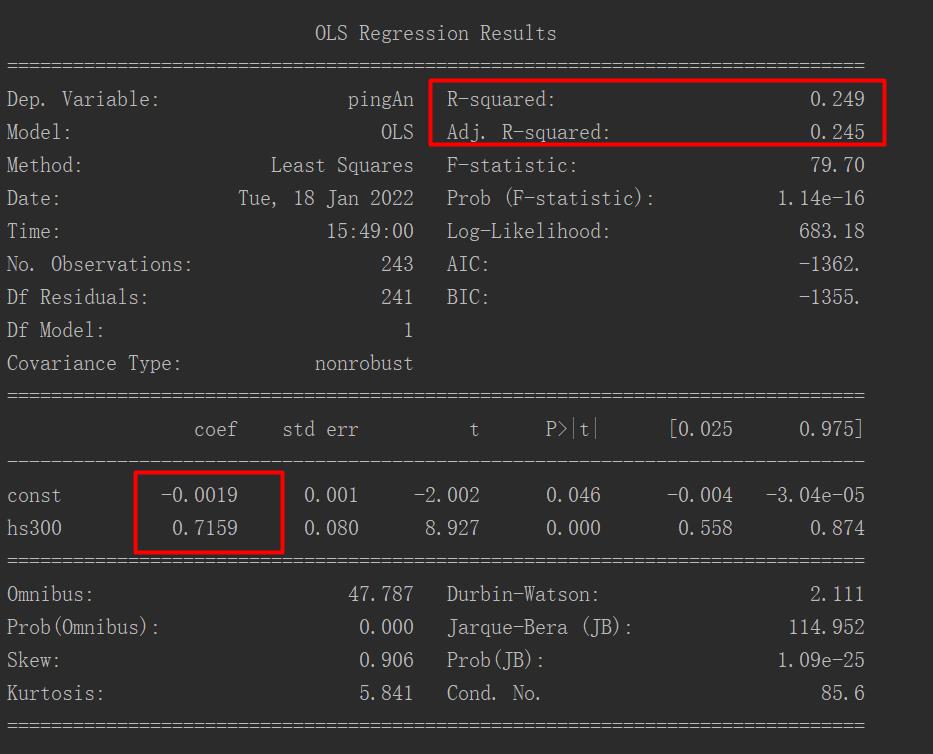

中国平安

OLS Regression Results

==============================================================================

Dep. Variable: pingAn R-squared: 0.249

Model: OLS Adj. R-squared: 0.245

Method: Least Squares F-statistic: 79.70

Date: Tue, 18 Jan 2022 Prob (F-statistic): 1.14e-16

Time: 15:49:00 Log-Likelihood: 683.18

No. Observations: 243 AIC: -1362.

Df Residuals: 241 BIC: -1355.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0019 0.001 -2.002 0.046 -0.004 -3.04e-05

hs300 0.7159 0.080 8.927 0.000 0.558 0.874

==============================================================================

Omnibus: 47.787 Durbin-Watson: 2.111

Prob(Omnibus): 0.000 Jarque-Bera (JB): 114.952

Skew: 0.906 Prob(JB): 1.09e-25

Kurtosis: 5.841 Cond. No. 85.6

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

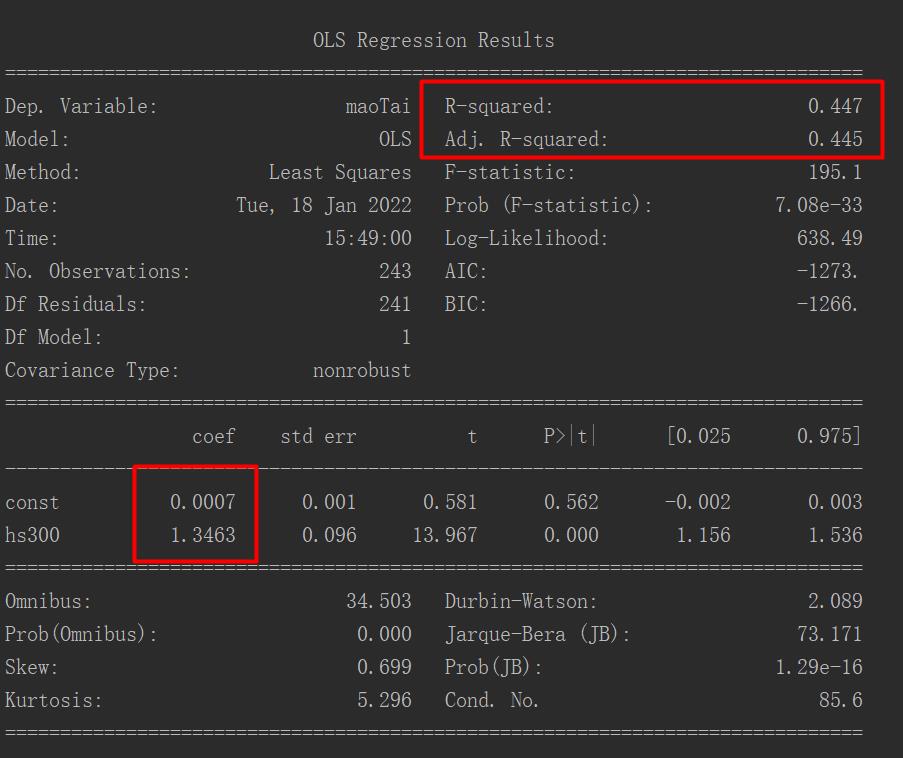

贵州茅台

OLS Regression Results

==============================================================================

Dep. Variable: maoTai R-squared: 0.447

Model: OLS Adj. R-squared: 0.445

Method: Least Squares F-statistic: 195.1

Date: Tue, 18 Jan 2022 Prob (F-statistic): 7.08e-33

Time: 15:49:00 Log-Likelihood: 638.49

No. Observations: 243 AIC: -1273.

Df Residuals: 241 BIC: -1266.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0007 0.001 0.581 0.562 -0.002 0.003

hs300 1.3463 0.096 13.967 0.000 1.156 1.536

==============================================================================

Omnibus: 34.503 Durbin-Watson: 2.089

Prob(Omnibus): 0.000 Jarque-Bera (JB): 73.171

Skew: 0.699 Prob(JB): 1.29e-16

Kurtosis: 5.296 Cond. No. 85.6

==============================================================================

这个数据的看法,关键是看这3个数据:

上面是平安的,截距项为-0.0019,意思就是除开大盘波动,自身还亏0.19%。β为0.7159,代表如大盘涨了10%,平安预期涨7.159%,R方为0.24代表拟合效果一般。

下面是茅台的

茅台的截距项为0.0007,代表除大盘波动带来的收益,其自身加载额外产生了0.07%的收益,β为1.3463,就是如果大盘涨了10%,那么茅台也涨13.463%,R方为0.44代表一般(0.5以上代码拟合可以)

以上是关于Python笔记-CAPM(资本资产定价模型)例子的主要内容,如果未能解决你的问题,请参考以下文章