Is Investment Expense a Proxy for Good Governance?

Posted 天津金融分析师

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了Is Investment Expense a Proxy for Good Governance?相关的知识,希望对你有一定的参考价值。

By Christopher K. Merker, PhD, CFA

Americans are a cost-conscious lot.

We all like a good deal. And that’s become especially clear when it comes to investing.

As an investment counselor, I now field questions that I didn’t hear a few years ago. Clients ask, “What’s the portfolio cost?” “Why aren’t we using more indexes?” “Why is this so expensive?”

In almost every governance survey of asset owners, investment expenses have emerged as one of the top three concerns.

Suddenly, a nation of “smart investors” has become a nation of “smart shoppers.”

This would be a good thing in normal circumstances. But cost-consciousness can eclipse more important considerations like investment objectives, purpose, allocation, cash-flow needs, and risk.

So how has the industry responded to this focus on expenses? With a race to zero.

If investors can meet the minimums, they can now invest in a large-cap value index product for three basis points (bps). That trumps the exchange-traded fund (ETF), which is trading at a shockingly pricey 20 bps. I’ve heard of an index that is actually free if the investor agrees to let the index manager lend out their securities.

Of course, this has put pressure on active managers, who haven’t cut their fees so much as their headcount, as they watch assets flow into more passive and less expensive investments. Concerned, investment professionals now must contemplate a market driven by mindless index funds with no regard to valuation of the underlying securities.

The top-heavy S&P 500 is just one example: Five stocks, the so-called “FAANG” — Facebook, Apple, Amazon, Netflix, and Google — have driven much of the index’s recent movements.

In August, I wrote about a five-year study on the governance and effectiveness of large institutional investors — public pension funds, in this case. We constructed a model of Fiduciary Effectiveness™ to understand the performance drivers of these larger institutions. We looked at the effect on investment return and funding ratios of several factors, including investment expenses. We found:

“For the control variables . . . with the exception of investment expenses, we had no particular expectation of signs. In the case of investment expenses, it was surprising on a couple of levels: 1) we expected that this would be a detractor to returns, and the opposite relationship was indicated in the estimation, and 2) the estimated coefficient was not statistically significant. The reason why this was a surprising result is because the industry has become obsessed with investment expenses over the past several years, which has fed into a debate over ‘active’ (higher-cost, research-driven, and actively managed investments) versus ‘passive’ (lower cost, index-defined) investments, and in this case we found no such relationship to investment returns.”

Investment costs don’t matter? How could that be?

If you pay less for something, doesn’t that imply you keep more for yourself? Not if you gave up something else in the process. For many investors, what is “given up” is performance. And not “active” performance necessarily, but governance-based performance, or what I refer to as structured group investor behavior.

It could be any number of decisions made by pension trustees: market timing, allocation decisions, or manager selection and termination, for example. But when the governance leading to these decisions is weak, so is the performance. According to our research, hundreds of basis points in performance are lost. So you initially saved 25 bps but gave up 200 bps relative to your better-performing peers? What good did that do?

Let’s examine the data.

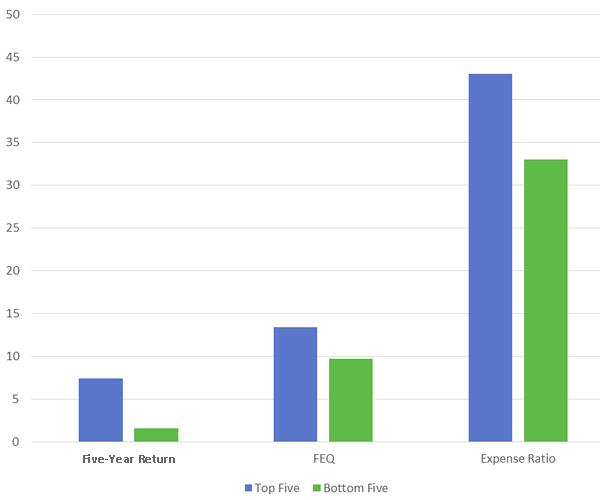

The graph below shows what is lost. It compares the average performance of the top- and bottom-five public pension plans based on five-year investment returns. Though the bottom five saved 25% on investment costs on average, they returned 80% less. The Fiduciary Effectiveness Quotient™ (FEQ) score is also included to gauge the difference in the governance index. Consistent with our other findings, the bottom five scored 30% below the top on average.

Average of Top-Five and Bottom-Five Public Pension Plans as Ranked by Five-Year Investment Returns

Source: FGA-Diagnostics, LLC (2008–2012). Average five-year returns are measured in percentages, the FEQ™ in standardized governance units, and expense ratios in basis points (bps). The FEQ is a trademark of FGA-Diagnostics, LLC, patent pending.

Why have investment expenses become such a focus? Because costs are hard, unchanging numbers that everybody can sink their teeth into. Performance numbers are the opposite: They are speculative, uncertain, and in the future.

It is human nature to want to control what we can control. We can make decisions about and act on investment expenses and feel good about it.

This is how controlling investment expenses became a proxy for good governance.

But such behavior has consequences. We have transformed the investment landscape, pushing almost a third of all assets and 50% of equities into this form of investing.

Regardless of where you stand on the active vs. passive debate, the overwhelming evidence shows that investors in general, but specifically the boards and organizations they serve, have not been effective. From my own study, 60% of public fund performance was at or below average — mostly below. The Dalbar study of individual investor behavior shows the problem is not confined to institutions. Something is clearly not working.

We need to revisit what we as investors are evaluating and where we are headed. I believe better measures and forms of governance are the solution to this problem.

Christopher K. Merker, PhD, CFA

Biography

Christopher K. Merker, PhD, CFA, is a director with Robert W. Baird & Co. Prior to joining Baird, he ran a successful venture capital incubator in New York's Silicon Alley. Merker holds a PhD in Investment Governance and Fiduciary Effectiveness from Marquette University. He is a past president of the CFA Society Milwaukee and a current board member. An adjunct professor of finance at Marquette University, where he teaches the investment course, Sustainable Finance, he is also executive director of Fund Governance Analytics, LLC, a provider of governance research and diagnostic tools for asset owners and institutional investors. He publishes the blog, Sustainable Finance, which covers current topics around sustainability in investing (www.sustainablefinanceblog.org).

(From CFAInstitute.org)

以上是关于Is Investment Expense a Proxy for Good Governance?的主要内容,如果未能解决你的问题,请参考以下文章

洛谷—— P2884 [USACO07MAR]每月的费用Monthly Expense