跨期套利策略

Posted

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了跨期套利策略相关的知识,希望对你有一定的参考价值。

策略想法:选取某一期货品种的主力合约和次主力合约,得到两个合约价格的价差,运用布林带指标,取前20分钟和2倍标准差,如果价差在布林带之外,入场,回到均值出场。

如下为策略代码:

#选取zn1701和zn1702合约的11月份交易分钟数据

#数据经过excel处理,两个合约数据按时间合并

#设置手续费和滑点为10元(两个合约买卖一次),平仓时扣除,

import pandas as pd

from pandas import Series,DataFrame

import numpy as np

import matplotlib.pyplot as plt

from numpy import nan

data=pd.read_excel(‘zn01_zn02.xlsx‘)

data[‘spread‘]=data[‘ZN01‘]-data[‘ZN02‘]

T=len(data.index)

#记录每次交易收益率

minute_return=[]

up_cross_up_limit=False

down_cross_down_limit=False

result_up= DataFrame(columns=[‘ZN01‘, ‘ZN02‘, ‘spread‘, ‘ZN01买卖方向‘, ‘ZN01开平‘, ‘ZN02买卖方向‘, ‘ZN02开平‘])

result_down= DataFrame(columns=[‘ZN01‘, ‘ZN02‘, ‘spread‘, ‘ZN01买卖方向‘, ‘ZN01开平‘, ‘ZN02买卖方向‘, ‘ZN02开平‘])

total_mean_line=[]

total_up_line=[]

total_down_line=[]

#生成T-20个元素为0列表,

a=[0]*(T-20)

for i in range(20,T):

#得到第i个spread前20个数据,并计算均值、方差、up_line、down_line

#计算结果均为整数

data_spread=data.iloc[i-20:i,2].values

# print(data_spread)

mean_20day_spread=data_spread.mean()

total_mean_line.append(mean_20day_spread)

# print(mean_20day_spread)

std_20day_spread=data_spread.std()

up_line=mean_20day_spread+2*std_20day_spread

total_up_line.append(up_line)

down_line=mean_20day_spread-2*std_20day_spread

total_down_line.append(down_line)

#将第i个spread与前20个spread得到up_line比较,决定是否开仓

if data.iloc[i,2]>up_line and not up_cross_up_limit:

up_open=data.iloc[i:i+1,:]

up_open = DataFrame(up_open,columns=[‘ZN01‘, ‘ZN02‘, ‘spread‘, ‘ZN01买卖方向‘, ‘ZN01开平‘, ‘ZN02买卖方向‘, ‘ZN02开平‘])

up_open[‘ZN01买卖方向‘] = ‘卖出‘

up_open[‘ZN01开平‘] = ‘开仓‘

up_open[‘ZN02买卖方向‘] = ‘买入‘

up_open[‘ZN02开平‘] = ‘开仓‘

#汇总

result_up=pd.concat([result_up,up_open])

#得到开仓spread

hold_spread = data.iloc[i, 2]

up_cross_up_limit=True

#i从20开始

a[i-20]=1

# 将第i个spread与前20个spread得到mean_20day_spread比较,决定是否平仓

elif data.iloc[i,2]<=mean_20day_spread and up_cross_up_limit:

down_close=data.iloc[i:i+1,:]

down_close = DataFrame(down_close,columns=[‘ZN01‘, ‘ZN02‘, ‘spread‘, ‘ZN01买卖方向‘, ‘ZN01开平‘, ‘ZN02买卖方向‘, ‘ZN02开平‘])

down_close[‘ZN01买卖方向‘] = ‘买入‘

down_close[‘ZN01开平‘] = ‘平仓‘

down_close[‘ZN02买卖方向‘] = ‘卖出‘

down_close[‘ZN02开平‘] = ‘平仓‘

result_up=pd.concat([result_up,down_close])

profit_yield = (hold_spread - data.iloc[i, 2] - 20) / (data.iloc[i, 0] + data.iloc[i, 1])

minute_return.append(profit_yield)

up_cross_up_limit=False

a[i-20] = 1

# 将第i个spread与前20个spread得到down_line比较,决定是否开仓

elif data.iloc[i,2]<down_line and not down_cross_down_limit:

down_open=data.iloc[i:i+1,:]

down_open = DataFrame(down_open,columns=[‘ZN01‘, ‘ZN02‘, ‘spread‘, ‘ZN01买卖方向‘, ‘ZN01开平‘, ‘ZN02买卖方向‘, ‘ZN02开平‘])

down_open[‘ZN01买卖方向‘] = ‘买入‘

down_open[‘ZN01开平‘] = ‘开仓‘

down_open[‘ZN02买卖方向‘] = ‘卖出‘

down_open[‘ZN02开平‘] = ‘开仓‘

#汇总

result_down=pd.concat([result_down,down_open])

hold_spread = data.iloc[i, 2]

down_cross_down_limit=True

a[i-20] = 1

# 将第i个spread与前20个spread得到down_line比较,决定是否平仓

elif data.iloc[i,2]>=mean_20day_spread and down_cross_down_limit:

up_close=data.iloc[i:i+1,:]

up_close = DataFrame(up_close,columns=[‘ZN01‘, ‘ZN02‘, ‘spread‘, ‘ZN01买卖方向‘, ‘ZN01开平‘, ‘ZN02买卖方向‘, ‘ZN02开平‘])

up_close[‘ZN01买卖方向‘] = ‘卖出‘

up_close[‘ZN01开平‘] = ‘平仓‘

up_close[‘ZN02买卖方向‘] = ‘买入‘

up_close[‘ZN02开平‘] = ‘平仓‘

result_down=pd.concat([result_down,up_close])

profit_yield = (data.iloc[i, 2] - hold_spread - 20)/ (data.iloc[i, 0] + data.iloc[i, 1])

minute_return.append(profit_yield)

down_cross_down_limit=False

a[i-20] = 1

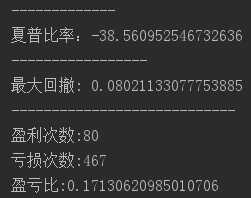

print(‘-------------‘)

transation=pd.concat([result_up,result_down]).sort_index()

# transation.to_csv(‘transation_detail.csv‘)

#计算sharpe

#计算总回报

total_return=np.expm1(np.log1p(minute_return).sum())

#计算年化回报

annual_return=(1+total_return)**(365/30)-1

risk_free_rate=0.015

std=np.array(minute_return).std()

volatility=std*(len(minute_return)**0.5)

annual_factor=12

annual_volatility=volatility*((annual_factor)**0.5)

sharpe=(annual_return-risk_free_rate)/annual_volatility

# print(total_return,annual_return,std,volatility,annual_volatility,sharpe)

print(‘夏普比率:{}‘.format(sharpe))

#计算最大回撤

#计算

df_cum=np.exp(np.log1p(minute_return).cumsum())

max_return=np.maximum.accumulate(df_cum)

max_drawdown=((max_return-df_cum)/max_return).max()

print(‘-----------------‘)

print(‘最大回撤: {}‘.format(max_drawdown))

#计算盈亏比plr

from collections import Counter

# win_times=Counter(x>0 for x in minute_return)

# loss_times=Counter(x<0 for x in minute_return)

win_times=sum(x>0 for x in minute_return)

loss_times=sum(x<0 for x in minute_return)

plr=win_times/loss_times

print(‘----------------------------‘)

print(‘盈利次数:{}‘.format(win_times))

print(‘亏损次数:{}‘.format(loss_times))

print(‘盈亏比:{}‘.format(plr))

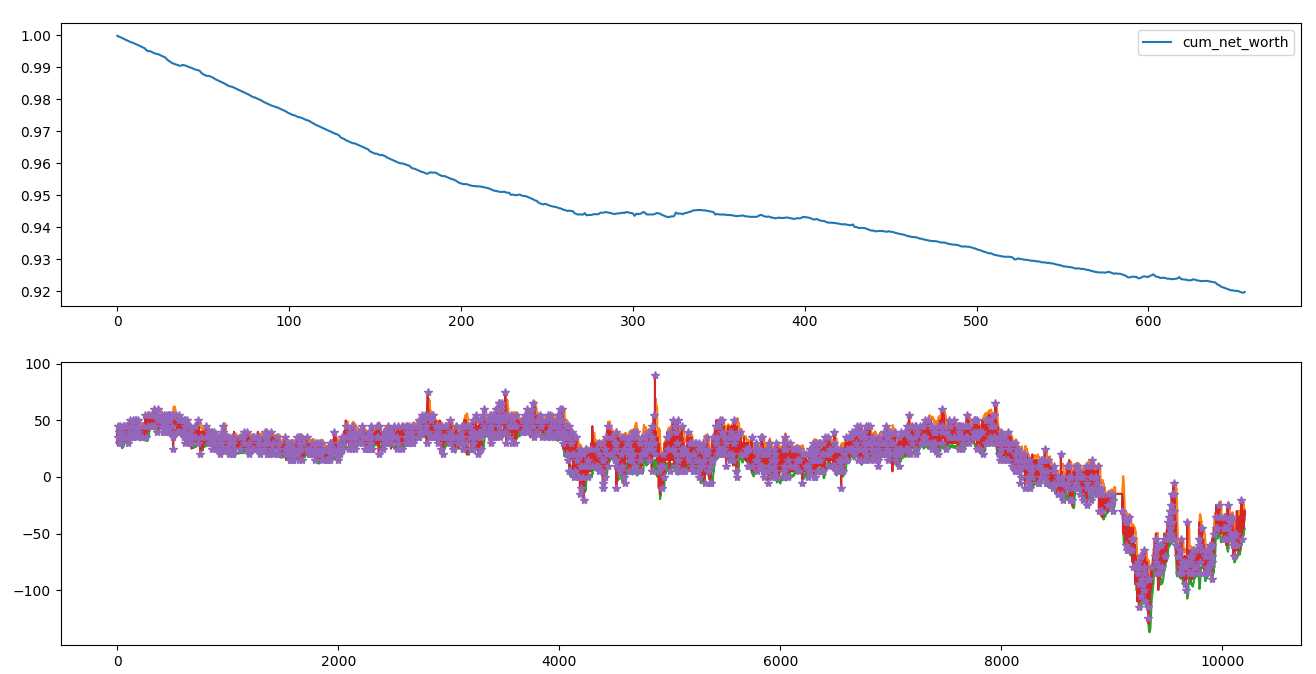

#画出净值走势图

fig=plt.figure()

ax1=fig.add_subplot(2,1,1)

cum_net_worth,=plt.plot(df_cum,label=‘cum_net_worth‘)

plt.legend([cum_net_worth],[‘cum_net_worth‘])

ax2=fig.add_subplot(2,1,2)

spread=data.iloc[20:,2].values

plt.plot(total_mean_line)

plt.plot(total_up_line)

plt.plot(total_down_line)

plt.plot(spread)

#标记进场、出场位置,先将格式转换为list

spread_mark=spread.tolist()

for i in range(T-20):

if a[i]==0:

spread_mark[i]=nan

elif a[i]==1:

spread_mark[i]=spread_mark[i]

plt.plot(spread_mark,‘*‘)

plt.show()

下面为运行结果图:

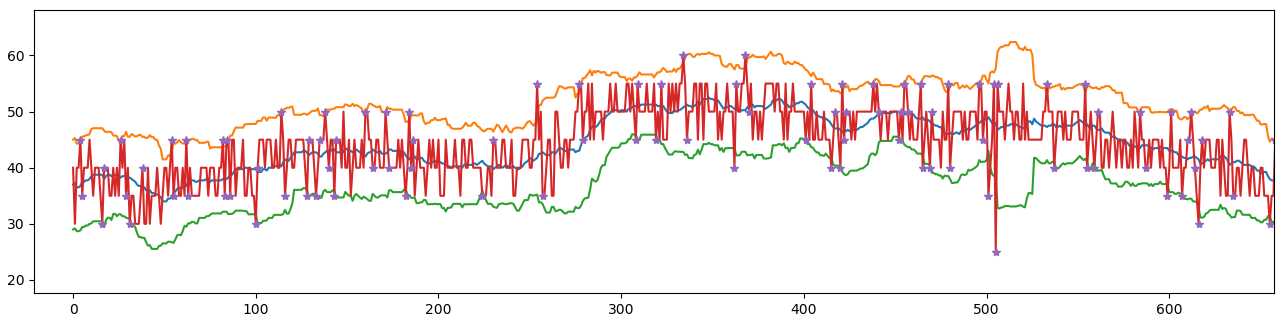

进场出场放大图:

以上是关于跨期套利策略的主要内容,如果未能解决你的问题,请参考以下文章