Python数据分析入门:比特币价格涨幅趋势分布

Posted 五包辣条!

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了Python数据分析入门:比特币价格涨幅趋势分布相关的知识,希望对你有一定的参考价值。

大家好,我是辣条。

曾经有一个真挚的机会,摆在我面前,但是我没有珍惜,等到失去的时候才后悔莫及,尘世间最痛苦的事莫过于此,如果老天可以再给我一个再来一次机会的话,我会买下那个比特币,哪怕付出所有零花钱,如果非要在这个机会加上一个期限的话,我希望是十年前。

看着这份台词是不是很眼熟,我稍稍改了一下,曾经差一点点点就购买比特币了,肠子都悔青了现在,今天对比特币做一个简单的数据分析。

# 安装对应的第三方库

!pip install pandas

!pip install numpy

!pip install seaborn

!pip install matplotlib

!pip install sklearn

!pip install tensorflow使用技术点:

1. 数据处理 - pandas

2. 科学运算 - numpy

3. 数据可视化 - seaborn matplotlib使用工具:

1. anaconda

2. notebook

3. python3.7版本导入第三方库

#a|T + enter notebook运行方式

import pandas as pd # 数据处理

import numpy as np # 科学运算

import seaborn as sns # 数据可视化

import matplotlib.pyplot as plt # 数据可视化

import warnings

import warnings

warnings.filterwarnings('ignore')如遇到导包报错 可以看看是不是自己的第三方库的版本问题

# 设置图表与 线格式

plt.rcParams['figure.figsize'] = (10, 10)

plt.rcParams['lines.linewidth'] = 2

plt.style.use('ggplot')

# 读取数据集

df = pd.read_csv('./DOGE-USD.csv')

df.head() # 查看前5行| Date | Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|---|

| 0 | 2014-09-17 | 0.000293 | 0.000299 | 0.000260 | 0.000268 | 0.000268 | 1463600.0 |

| 1 | 2014-09-18 | 0.000268 | 0.000325 | 0.000267 | 0.000298 | 0.000298 | 2215910.0 |

| 2 | 2014-09-19 | 0.000298 | 0.000307 | 0.000275 | 0.000277 | 0.000277 | 883563.0 |

| 3 | 2014-09-20 | 0.000276 | 0.000310 | 0.000267 | 0.000292 | 0.000292 | 993004.0 |

| 4 | 2014-09-21 | 0.000293 | 0.000299 | 0.000284 | 0.000288 | 0.000288 | 539140.0 |

df.isnull().sum() # 统计缺失值的总和(sum())

Date 0

Open 5

High 5

Low 5

Close 5

Adj Close 5

Volume 5

dtype: int64

df.duplicated().sum() # 查看重复值

0

# 数据类型 分布基本情况

df.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 2591 entries, 0 to 2590

Data columns (total 7 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Date 2591 non-null object

1 Open 2586 non-null float64

2 High 2586 non-null float64

3 Low 2586 non-null float64

4 Close 2586 non-null float64

5 Adj Close 2586 non-null float64

6 Volume 2586 non-null float64

dtypes: float64(6), object(1)

memory usage: 141.8+ KB

# 转换 Date的类型

df['Date'] = pd.to_datetime(df.Date, dayfirst=True)

# 索引重置 让Date时间格式成为 索引 inplace新建对象

df.set_index('Date', inplace=True)

df| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2014-09-17 | 0.000293 | 0.000299 | 0.000260 | 0.000268 | 0.000268 | 1.463600e+06 |

| 2014-09-18 | 0.000268 | 0.000325 | 0.000267 | 0.000298 | 0.000298 | 2.215910e+06 |

| 2014-09-19 | 0.000298 | 0.000307 | 0.000275 | 0.000277 | 0.000277 | 8.835630e+05 |

| 2014-09-20 | 0.000276 | 0.000310 | 0.000267 | 0.000292 | 0.000292 | 9.930040e+05 |

| 2014-09-21 | 0.000293 | 0.000299 | 0.000284 | 0.000288 | 0.000288 | 5.391400e+05 |

| ... | ... | ... | ... | ... | ... | ... |

| 2021-10-16 | 0.233881 | 0.244447 | 0.233683 | 0.237292 | 0.237292 | 1.541851e+09 |

| 2021-10-17 | 0.237193 | 0.241973 | 0.226380 | 0.237898 | 0.237898 | 1.397143e+09 |

| 2021-10-18 | 0.237806 | 0.271394 | 0.237488 | 0.247281 | 0.247281 | 5.003366e+09 |

| 2021-10-19 | NaN | NaN | NaN | NaN | NaN | NaN |

| 2021-10-20 | 0.245199 | 0.246838 | 0.242384 | 0.246078 | 0.246078 | 1.187871e+09 |

2591 rows × 6 columns

df = df.asfreq('d') # 按照天数采集数据

df = df.fillna(method='bfill') # 缺失值填充 下一条数据填充

df| Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2014-09-17 | 0.000293 | 0.000299 | 0.000260 | 0.000268 | 0.000268 | 1.463600e+06 |

| 2014-09-18 | 0.000268 | 0.000325 | 0.000267 | 0.000298 | 0.000298 | 2.215910e+06 |

| 2014-09-19 | 0.000298 | 0.000307 | 0.000275 | 0.000277 | 0.000277 | 8.835630e+05 |

| 2014-09-20 | 0.000276 | 0.000310 | 0.000267 | 0.000292 | 0.000292 | 9.930040e+05 |

| 2014-09-21 | 0.000293 | 0.000299 | 0.000284 | 0.000288 | 0.000288 | 5.391400e+05 |

| ... | ... | ... | ... | ... | ... | ... |

| 2021-10-16 | 0.233881 | 0.244447 | 0.233683 | 0.237292 | 0.237292 | 1.541851e+09 |

| 2021-10-17 | 0.237193 | 0.241973 | 0.226380 | 0.237898 | 0.237898 | 1.397143e+09 |

| 2021-10-18 | 0.237806 | 0.271394 | 0.237488 | 0.247281 | 0.247281 | 5.003366e+09 |

| 2021-10-19 | 0.245199 | 0.246838 | 0.242384 | 0.246078 | 0.246078 | 1.187871e+09 |

| 2021-10-20 | 0.245199 | 0.246838 | 0.242384 | 0.246078 | 0.246078 | 1.187871e+09 |

2591 rows × 6 columns

In [14]:

# 开盘价的分布情况

df['Open'].plot(figsize=(12, 8))

结论:从上图可以看出 BTB是在2021年份开始爆发式的增长 在2015 到 2021 一直都是没有较大波动

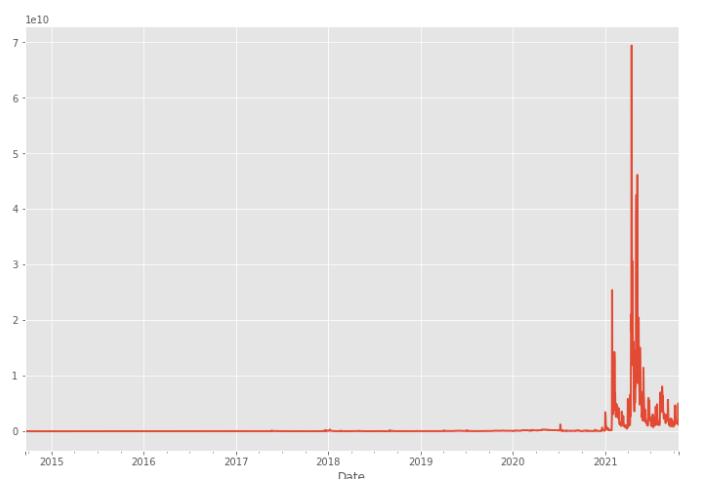

# 成交情况

df['Volume'].plot(figsize=(12, 8))

# 投资价值

df['Total Pos'] = df.sum(axis=1)

df['Total Pos'].plot(figsize=(10, 8))

结论:开盘价高 投资价值搞 比较合适做卖出操作 实现一夜暴富(开玩笑的)

# 当前元素与先前元素的相差百分比

df['Daily Reture'] = df['Total Pos'].pct_change(1)

# 日收益率的平均

df['Daily Reture'].mean()

df['Daily Reture'].plot(kind='kde')

SR = df['Daily Reture'].mean() / df['Daily Reture'].std()

all_plot = df/df.iloc[0]

all_plot.plot(figsize=(24, 16))

df.hist(bins=100, figsize=(12, 6))

# 按照年份进行采样

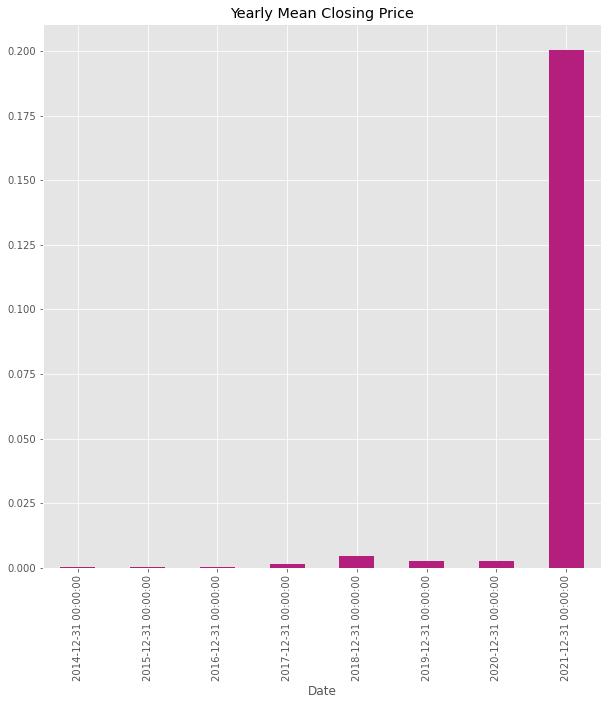

df.resample(rule='A').mean()| Open | High | Low | Close | Adj Close | Volume | Total Pos | Daily Reture | |

|---|---|---|---|---|---|---|---|---|

| Date | ||||||||

| 2014-12-31 | 0.000249 | 0.000259 | 0.000240 | 0.000248 | 0.000248 | 8.059213e+05 | 8.059213e+05 | 1.028630 |

| 2015-12-31 | 0.000143 | 0.000147 | 0.000139 | 0.000143 | 0.000143 | 1.685476e+05 | 1.685476e+05 | 0.139461 |

| 2016-12-31 | 0.000235 | 0.000242 | 0.000229 | 0.000235 | 0.000235 | 2.564834e+05 | 2.564834e+05 | 0.259038 |

| 2017-12-31 | 0.001576 | 0.001708 | 0.001468 | 0.001601 | 0.001601 | 1.118996e+07 | 1.118996e+07 | 0.225833 |

| 2018-12-31 | 0.004368 | 0.004577 | 0.004125 | 0.004350 | 0.004350 | 2.172325e+07 | 2.172325e+07 | 0.109586 |

| 2019-12-31 | 0.002564 | 0.002631 | 0.002499 | 0.002563 | 0.002563 | 4.463969e+07 | 4.463969e+07 | 0.027981 |

| 2020-12-31 | 0.002736 | 0.002822 | 0.002660 | 0.002744 | 0.002744 | 1.290465e+08 | 1.290465e+08 | 0.052314 |

| 2021-12-31 | 0.200410 | 0.215775 | 0.185770 | 0.201272 | 0.201272 | 4.620961e+09 | 4.620961e+09 | 0.260782 |

# 年平均收盘价

df['Open'].resample('A').mean().plot.bar(title='Yearly Mean Closing Price', color=['#b41f7d'])

# 月度

df['Open'].resample('M').mean().plot.bar(figsize=(18, 12), color='red')

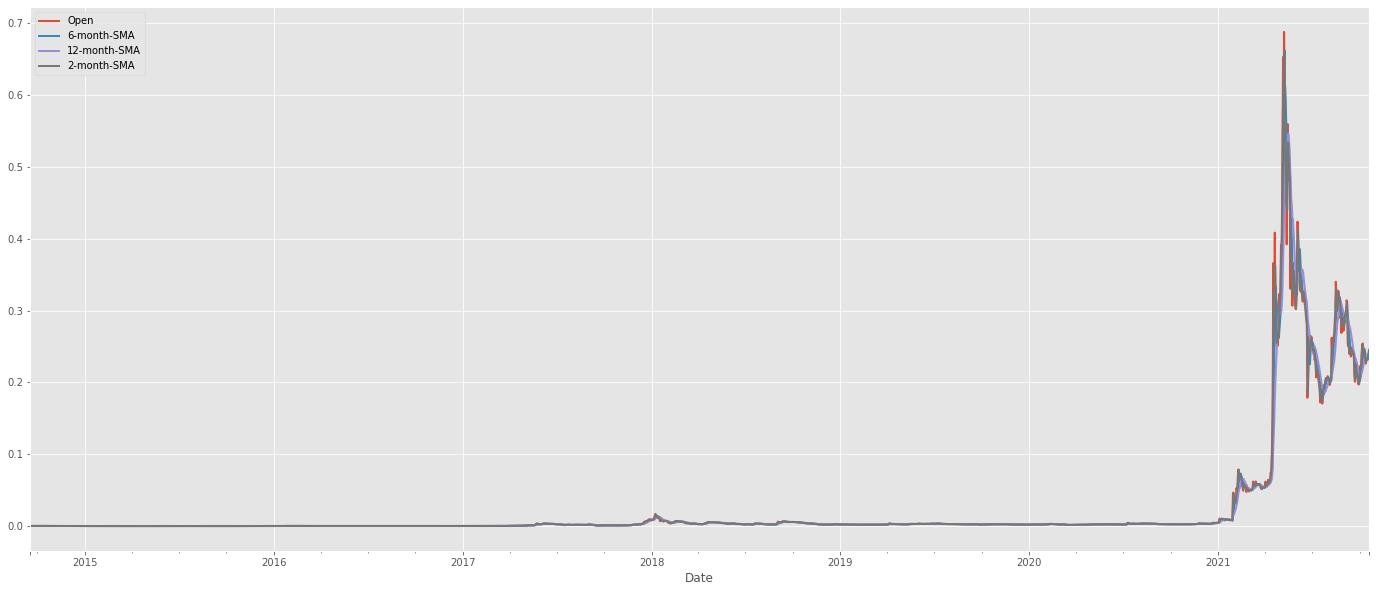

# 分别获取对应时间窗口 6 12 2 均值

df['6-month-SMA'] = df['Open'].rolling(window=6).mean()

df['12-month-SMA'] = df['Open'].rolling(window=12).mean()

df['2-month-SMA'] = df['Open'].rolling(window=2).mean()

df.head(10)| Open | High | Low | Close | Adj Close | Volume | Total Pos | Daily Reture | 6-month-SMA | 12-month-SMA | 2-month-SMA | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||

| 2014-09-17 | 0.000293 | 0.000299 | 0.000260 | 0.000268 | 0.000268 | 1463600.0 | 1.463600e+06 | NaN | NaN | NaN | NaN |

| 2014-09-18 | 0.000268 | 0.000325 | 0.000267 | 0.000298 | 0.000298 | 2215910.0 | 2.215910e+06 | 0.514013 | NaN | NaN | 0.000281 |

| 2014-09-19 | 0.000298 | 0.000307 | 0.000275 | 0.000277 | 0.000277 | 883563.0 | 8.835630e+05 | -0.601264 | NaN | NaN | 0.000283 |

| 2014-09-20 | 0.000276 | 0.000310 | 0.000267 | 0.000292 | 0.000292 | 993004.0 | 9.930040e+05 | 0.123863 | NaN | NaN | 0.000287 |

| 2014-09-21 | 0.000293 | 0.000299 | 0.000284 | 0.000288 | 0.000288 | 539140.0 | 5.391400e+05 | -0.457062 | NaN | NaN | 0.000285 |

| 2014-09-22 | 0.000288 | 0.000301 | 0.000285 | 0.000298 | 0.000298 | 620222.0 | 6.202220e+05 | 0.150391 | 0.000286 | NaN | 0.000291 |

| 2014-09-23 | 0.000298 | 0.000318 | 0.000295 | 0.000313 | 0.000313 | 739197.0 | 7.391970e+05 | 0.191826 | 0.000287 | NaN | 0.000293 |

| 2014-09-24 | 0.000314 | 0.000353 | 0.000310 | 0.000348 | 0.000348 | 1277840.0 | 1.277840e+06 | 0.728687 | 0.000295 | NaN | 0.000306 |

| 2014-09-25 | 0.000347 | 0.000383 | 0.000332 | 0.000375 | 0.000375 | 2393610.0 | 2.393610e+06 | 0.873169 | 0.000303 | NaN | 0.000331 |

| 2014-09-26 | 0.000374 | 0.000467 | 0.000373 | 0.000451 | 0.000451 | 4722610.0 | 4.722610e+06 | 0.973007 | 0.000319 | NaN | 0.000361 |

进行可视化 查看对应分布情况

df[['Open', '6-month-SMA', '12-month-SMA', '2-month-SMA']].plot(figsize=(24, 10))

df[["Open","6-month-SMA"]].plot(figsize=(18,10))

df[['Open','6-month-SMA']].iloc[:100].plot(figsize=(12,6)).autoscale(axis='x',tight=True)

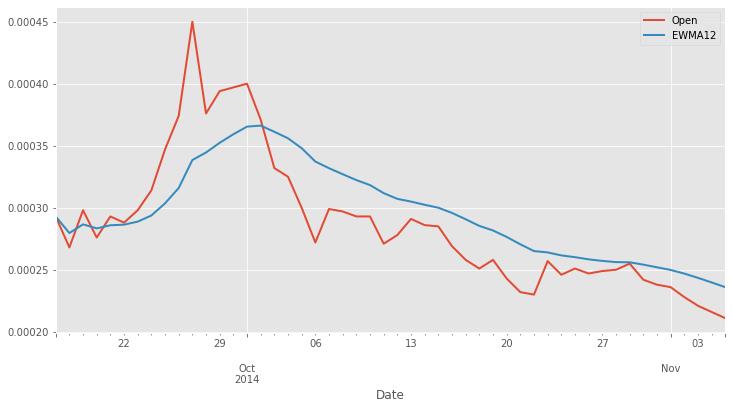

df['EWMA12'] = df['Open'].ewm(span=14,adjust=True).mean()

df[['Open','EWMA12']].plot(figsize=(24,12))

df[['Open','EWMA12']].iloc[:50].plot(figsize=(12,6)).autoscale(axis='x',tight=True)

👇🏻 疑难解答、学习资料、路线图可通过搜索下方 👇🏻

以上是关于Python数据分析入门:比特币价格涨幅趋势分布的主要内容,如果未能解决你的问题,请参考以下文章

比特币“挖矿”潮蔓延:“矿工”和游戏玩家抢显卡致价格疯涨 概念股或受益