DBA捷报 | 范瑗瑗同学论文答辩圆满完成

Posted 长江DBA

tags:

篇首语:本文由小常识网(cha138.com)小编为大家整理,主要介绍了DBA捷报 | 范瑗瑗同学论文答辩圆满完成相关的知识,希望对你有一定的参考价值。

梅花香自苦寒来,2020年1月13日,企业家学者项目三期班同学、赛领资本合伙人、董事总经理范瑗瑗顺利通过论文答辩。本次答辩在北京进行,北京、深圳、新加坡三地连线,跨洋见证收获时刻。范瑗瑗同学围绕《跨国并购绩效:中国实证分析》进行了详细的论证,学术成果丰硕。答辩虽在线上进行,但范瑗瑗同学和各位导师依然以最认真严谨的态度和饱满的热情思辨交流。恭喜范瑗瑗同学顺利通过答辩,也让我们一起回顾答辩时的精彩瞬间。

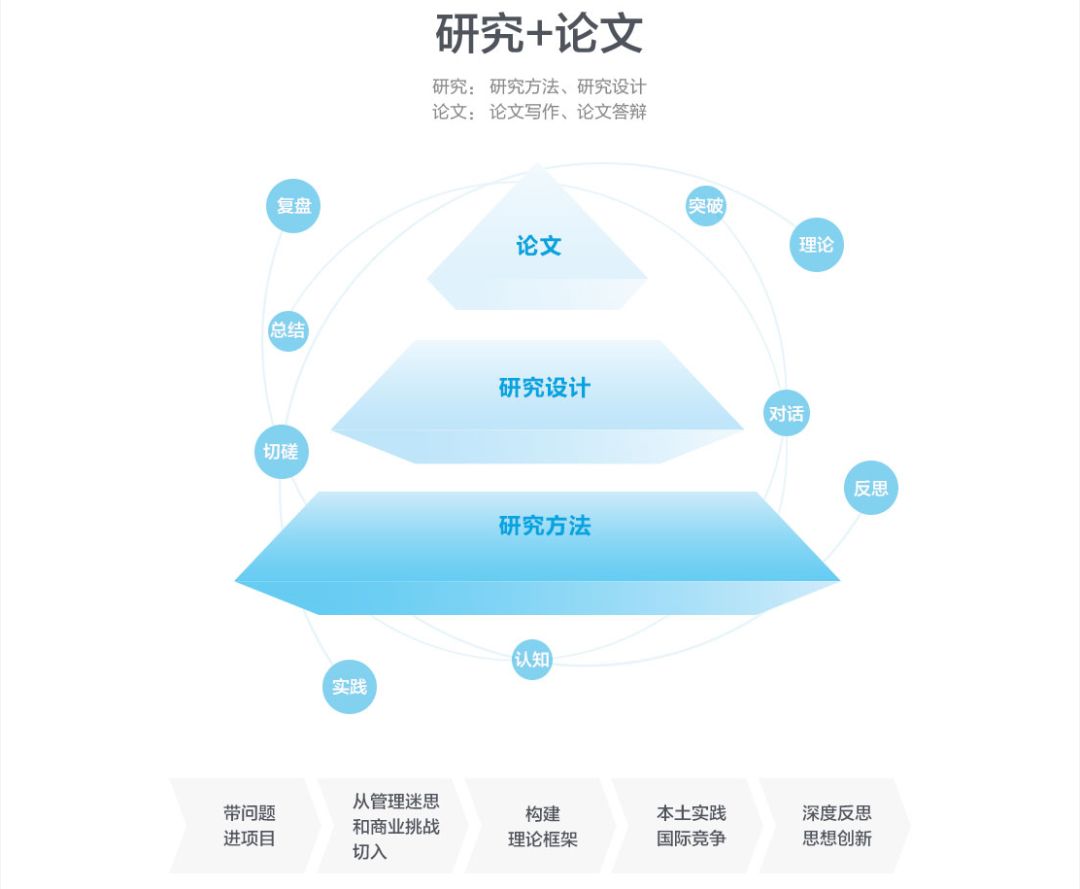

历练之路

企业家学者项目整合全球教育资源,秉持成就新商业文明思想者和引领者的愿景,打造具有框架性、系统性、前沿性和全球化的创新课程。同时,企业家学者项目深刻洞察全球经济转型与发展,深入总结行业趋势和规律,以应用型研究为导向,将学术的严谨与新鲜的实践碰撞。范瑗瑗同学在这样的学习与体验中不断提升,实现了“理解-判断-实践-引领”的跨越式发展,积极参与全球化进程,与优秀企业家共同迎接新商业文明的挑战,为中国和全球经济发展贡献“长江力量”。

学术的见证者

来自长江商学院与新加坡管理大学(SMU)的教授们共同见证了范瑗瑗同学的学术成果!

CHENG QIANG

Dean, School of Accountancy,SMU

LIU JING

Professor of Accounting and Finance,CKGSB

CHEN XIA

Professor of Accounting,LKCSB,SMU

思想之舞

▶ 范瑗瑗:跨国并购绩效-中国实证分析

范瑗瑗在答辩现场

▇ 论文摘要:

近年来,中国的跨境并购数量大幅增加。随着“走出去”战略的实施,中国企业投入了更多的资本和时间来发展海外业务。在这些项目中,跨国并购所占比例相对较大。因此,分析哪些因素会影响跨国收购的绩效至关重要。

答辩现场

以前的研究表明,收购方的并购后绩效受到各种因素的影响。本论文主要研究国内并购,但跨国并购也有其独特之处。在本研究中,我主要关注中国的跨国并购以及影响收购方并购后绩效的因素。我首先进行了几个案例研究,分析了中国的跨境收购交易,并将其与美国的交易进行了比较。此外,我分析了中国企业的一个国内收购案例,并将其与中国收购方所进行的跨境收购进行了比较。我发现相比于国内并购,跨国并购后整合会面临更多的问题。在研究的第二部分,我进行了一系列的实证分析。我从SDC数据库中收集了中国的跨境并购交易,并将此数据与CRMAR数据库中的数据进行人工匹配。从实证研究中,我发现收购方的海外经验与更好的并购后绩效和市场反应相关。此外,注册地在发达地区的收购目标与注册地在欠发达地区的收购目标表现出不同的交易特征。然而,合并后的长期绩效并不随收购目标的注册地国家而异。总之,我的研究表明,跨国并购需要进行彻底的尽职调查,并更加关注并购后整合。

尽管市场对收购不同国家注册地的目标公司可能会有不同的反应,但长期绩效不受目标公司注册地国家的影响,这表明当收购注册地在欠发达地区的目标公司时,市场可能并不认可跨国收购的价值。

范瑗瑗在企业家学者项目中

▇ Abstract:

The number of cross-border mergers and acquisitions (M&A) in China increased dramatically these years. With the “go global” strategy, Chinese firms devote more capital and time to develop their overseas business. Among these activities, cross-border M&As take up a relatively larger proportion. Therefore, it is crucial to analysis what factors can affect the performance of cross-border acquisitions.

Previous studies have shown that acquirers’ post-merger performance is affected by various factors. This paper mainly focusses on domestic M&A. However, cross-border M&As also have unique features. In this study, I focus on Chinese cross-border acquisitions and the factors that affect the acquirers’ post-merger performance. I start my research with a few case studies. I analyzed Chinese cross-border acquisition deals and compared them with U.S. deals. In addition, I examined one domestic acquisition of Chinese corporate and compared it with cross-border acquisitions conducted by Chinese acquirers. I found that post-merger integration for cross-border acquisitions faces more issues than that for domestic acquisitions. In the second part of my study, I conducted a series of empirical analyses. I collected Chinese cross-border deals from the SDC database and manually matched the data to data from the CRMAR database. From the empirical study, I found that acquirers’ overseas experience associated with better post-merger performance and market reactions. Moreover, the deal characteristics differ between targets incorporated in developed areas and those incorporated in less-developed areas. However, long-term post-merger performance does not vary with target incorporated nations. To conclude, my study shows that cross-border acquisitions need to conduct thorough due diligence and pay more attention to post-merger acquisitions.

Although the market might have different reactions to the acquisitions of firms incorporated in different countries, long-term performance is not affected by the target nation, which indicates the market might not appreciate the value of the cross-border acquisition when the firm’s takeover a target in a less developed area.

北京答辩现场合影

一分耕耘、一分收获,在新春即将到来之际顺利通过答辩,是范瑗瑗同学送给自己最好的礼物。作为优秀的女性企业家领袖,范瑗瑗同学以专业的素养和认真的态度面对每一个挑战。巾帼不让须眉,我们期待她在未来的工作中,为新商业文明发展助力!

以上是关于DBA捷报 | 范瑗瑗同学论文答辩圆满完成的主要内容,如果未能解决你的问题,请参考以下文章